Cryptorino KYC: Does the casino require verification in reality?

Cryptorino KYC doesn’t apply right from the start, which is pretty good news in an industry where some platforms demand full documentation before you can even make your first deposit.

If you’re curious about the platform’s overall features and bonuses, check out my Cryptorino casino review for the full breakdown.

That said, Cryptorino reserves the right to request additional verification in certain situations, so it’s smart to know when and why that might happen.

🔑 Key takeaways

- Cryptorino requires only Level 1 verification for most players – basic personal details with no document uploads

- Full KYC checks are triggered case-by-case, usually tied to withdrawal amounts or suspicious activity patterns

- The casino complies with anti-money laundering regulations, which means large or irregular transactions can flag your account

- Unlike Stake.com verification, which is mandatory from day one, Cryptorino lets you play first and verify later if needed

Does Cryptorino require KYC?

Yes and no, depending on how you use the platform.

For most players, Cryptorino sticks to Level 1 verification, which means you fill in basic details like your name, address, and date of birth. No ID uploads, no selfies, no utility bills.

It’s similar to Shuffle’s KYC, where you can deposit and withdraw small to moderate amounts without ever uploading a document.

That changes if Cryptorino’s compliance team flags your account.

According to the Terms of Service:

We reserve the right to verify your identity at any time at our discretion for any reason should this deemed necessary by Us.

In practice, most casual players won’t face additional checks.

But if you’re moving larger sums or your account shows patterns that raise red flags, expect the casino to ask for more.

Still, if you’re a casual player, you won’t have issues withdrawing $50-100 – for instance, Roobet’s ID verification is triggered upon the first withdrawal attempt.

When does Cryptorino trigger verification?

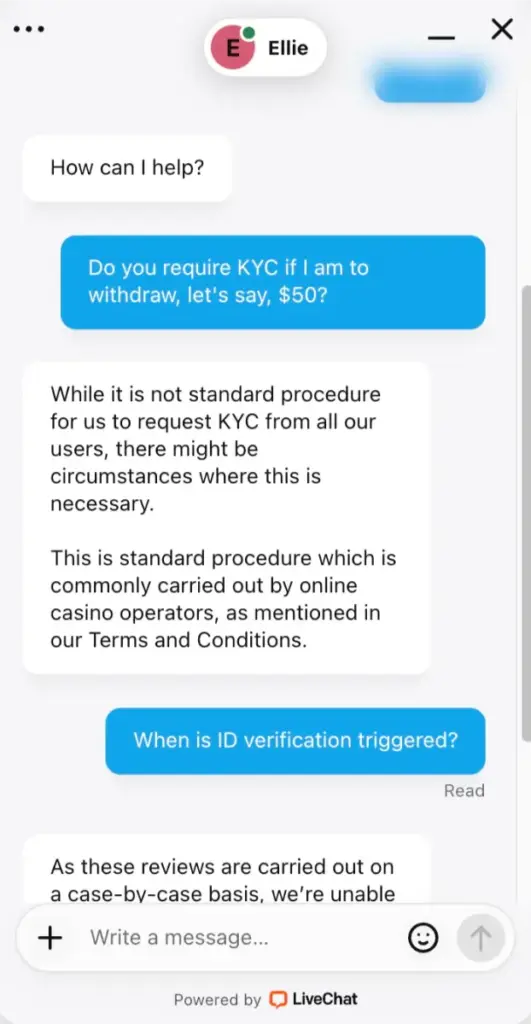

Cryptorino doesn’t publish exact thresholds for when KYC kicks in, and when I asked support directly, they confirmed reviews happen on a case-by-case basis.

Based on the Terms of Service and industry norms, here’s when you’re most likely to face additional verification:

- Large withdrawals: The €5,000 daily limit is a soft cap. Go beyond that consistently, and the casino will want to confirm you’re legit.

- Rapid deposit and withdrawal cycles: If you deposit, play minimally, and withdraw repeatedly, it looks like money laundering.

- Multiple accounts or IP mismatches: One account per person, household, and IP address. Violate this, and your account may get flagged.

- Suspicious activity patterns: Bonus abuse, coordinated play with other accounts, or using VPNs from restricted regions.

The T&Cs make this clear:

The company complies with laws, regulations and guidelines for the prevention of money laundering and the funding of terrorism. Suspicious transactions shall be investigated by the company.

If your account gets flagged, Cryptorino can lock withdrawals until you provide the documents they request.

What Cryptorino asks for in Level 1 verification?

Level 1 is straightforward and takes less than two minutes.

You provide:

- Full name

- Date of birth

- Full address

- Phone number

No documents, no photos, no hassle.

The casino uses this info to create your player profile and comply with basic regulatory requirements.

It’s enough to deposit, play, and cash out smaller amounts without further checks.

One thing to note: don’t lie on Level 1.

Don’t lie.

If Cryptorino does escalate to full KYC later and your details don’t match your documents, you’ll lose access to your funds.

The casino rules are very strict, so don’t try to bypass them.

How to verify your Cryptorino account?

If Cryptorino asks for verification, the process is pretty simple. Y

You’ll receive an email with specific instructions on what documents to submit.

Here’s the typical flow:

- Check your email

Cryptorino will contact you at your registered address with details on what they need. - Gather your documents

This usually means a government-issued ID (passport, driver’s license, or national ID card). For higher levels, you might need proof of address or source of funds. - Submit and wait

Upload the requested documents and give the team 24 to 48 hours to review them. In some cases, it might take a bit longer. - Respond quickly if needed

If Cryptorino asks for additional info, reply fast to avoid delays.

Most players won’t ever go beyond Level 1.

Let’s be honest – it’s much better than Stake’s verification, which won’t let you sniff any opportunity to play without adding ID.

Best Cryptorino alternatives with minimal KYC

If you want even lighter verification requirements, here are some solid options:

Tips for smooth Cryptorino verification

Even though Cryptorino keeps KYC light, it’s worth being prepared in case the casino asks for more.

- Complete Level 1 accurately from the start: False information won’t help you, and it can backfire hard if the casino decides to verify you later. Make sure your name, address, and birth date match what’s on your ID.

- Keep documents ready: If you’re planning to withdraw larger amounts, have your ID and proof of address scanned and saved in a folder. Being prepared saves time if verification gets triggered.

- Avoid behavior that raises red flags: Don’t create multiple accounts, don’t use VPNs to bypass geo-restrictions, and don’t deposit and withdraw without playing. These patterns scream “money laundering” to compliance teams.

- Stay within the limits: Cryptorino’s default withdrawal cap is €5,000 per day. If you need to move more, contact support first. Trying to bypass limits by creating multiple accounts is a fast track to account closure.

Final thoughts

Cryptorino strikes a good balance between player privacy and regulatory compliance.

For most users, Level 1 verification is all you’ll ever need.

The casino doesn’t force document uploads unless something about your account triggers a review, which keeps the signup process fast and friction-free.

If you keep your activity normal and stick to smaller deposits and withdrawals, you’ll likely never face additional checks.