Snatch Casino KYC: What do you need to know?

KYC at Snatch Casino isn’t pushed in your face, but it’s not something you can ignore either.

The platform follows a selective verification model – play first, verify later if needed.

Here’s how Snatch handles KYC, when it kicks in, and what actually matters.

🔑 Key takeaways

- Snatch doesn’t require full KYC upfront for all players

- Basic Level 1 verification is completed during sign-up

- Full KYC is requested only when certain triggers apply

- Verification can’t be bypassed if it’s formally requested

Does Snatch Casino require KYC?

Snatch Casino follows a selective KYC model, which means full verification isn’t enforced by default.

Level 1 checks are completed during sign-up and cover basic personal details, but that’s usually where it stops for most players.

In that sense, the approach is very similar to Shuffle’s KYC, where light verification exists, but deeper checks are triggered only when needed.

Compared to Roobet’s KYC, Snatch feels noticeably less strict.

You’re not pushed into document uploads early, and normal play isn’t interrupted by verification prompts unless there’s a clear reason.

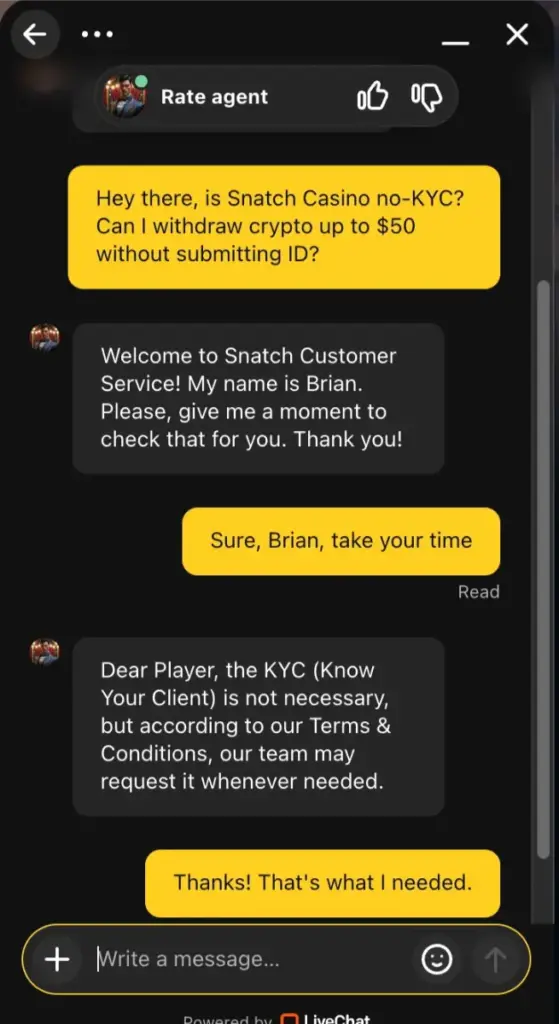

To be sure, I contacted live chat directly.

The agent confirmed that KYC is not mandatory upfront, but the casino reserves the right to request it under certain conditions, in line with their terms.

When does Snatch ask for KYC?

Snatch doesn’t push verification early, but KYC can be triggered once certain thresholds are reached.

Based on my experience, the first time you withdraw $2,000 is when the systems are triggered and additional checks may follow.

Until then, regular play usually stays uninterrupted.

For comparison, Stake KYC is triggered before you even reach the deposit hub, while Snatch waits for concrete risk signals.

KYC is typically requested when:

- You attempt higher-value withdrawals

- Unusual activity or patterns are flagged

- Compliance checks require a source-of-funds review

In my opinion, it’s more a matter of if than when you’ll be asked for verification, which is always a green flag in my book.

What documents does Snatch Casino require?

Snatch Casino doesn’t request documents by default, but once KYC is triggered, the process follows a familiar structure.

The goal is to confirm identity, age, and payment ownership rather than create friction.

Documents that may be requested include:

- Government-issued photo ID (passport or ID card)

- Proof of address (utility bill or bank statement)

- Payment method verification, if needed

These checks align with standard KYC requirements across licensed crypto casinos and usually apply only when withdrawals or limits increase.

How to pass Snatch Casino KYC?

Passing KYC at Snatch Casino is straightforward if you follow the rules.

The process isn’t aggressive, but accuracy matters once verification is requested.

Here’s how to pass the verification easily:

- Make sure your profile details are correct and consistent

- Upload a clear government-issued ID if requested

- Provide a recent proof of address when asked

- Verify the payment method used for deposits

- Respond promptly to any follow-up from support

Can you bypass Snatch Casino verification?

Trying to bypass verification at Snatch Casino isn’t a smart move.

While the platform doesn’t demand documents upfront and keeps early registration light, that flexibility only works if the information you provide is accurate.

You won’t need to upload IDs or proof of address at the start, which keeps onboarding smooth for most players.

That said, if verification is requested later and you avoid it or submit false details, the outcome is rarely positive.

Account suspension, delayed withdrawals, or full account closure are all realistic risks.

Final words

Snatch Casino strikes a balance between light verification where it matters and firm verification where it needs to be. Most players won’t feel KYC at all during regular play.

Play straight, verify when asked, and Snatch remains a smooth, reliable option for crypto-focused players.