Thrill Casino KYC guide 2026: What you need to know about verification

If you want to test new waters, Thrill Casino may be a good place to start. But as usual, the “hidden facts” are what make-or-break platforms.

I’ve spent time getting into Thrill Casino’s verification process and dissecting their terms and conditions to uncover what really happens when you try to withdraw your winnings.

🔑 Key takeaways

- Thrill Casino has four verification levels, starting with personal details and moving up to full source-of-wealth checks for high-value accounts.

- KYC usually happens at withdrawal, after large transactions, or when the system flags unusual activity.

- Not completing KYC can result in suspension, blocked withdrawals, and account closure.

- Accurate documents ready in advance help you pass verification quickly and keep playing without delays.

Does Thrill require KYC?

Yes, Thrill Casino does require KYC verification, though the process isn’t immediately triggered during sign-up.

The casino’s terms and conditions clearly state their right to request identification documents at any time.

According to Thrill’s T&Cs:

We reserve the right at any time to request identification documents, including those specified in our Anti-Money Laundering (AML) Policy, to verify your identity, age, and location.

When I tested the site after launch, I was able to withdraw without being verified.

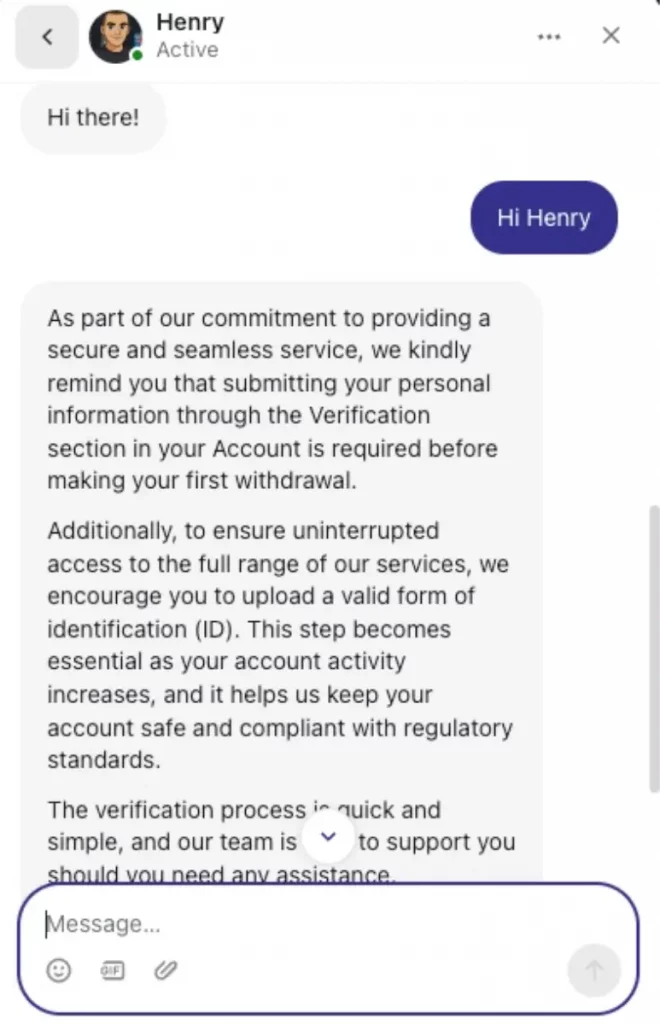

Support told me that current policies are stricter than before.

The reality is that while you might get lucky and avoid KYC for small amounts initially, you should expect verification to be triggered eventually, especially for larger withdrawals or if your account activity raises any flags.

It’s not uncommon, though – Stake KYC is already triggered before your first deposit.

Thrill Casino verification levels

Thrill uses a four-step verification system, similar to what Roobet KYC does.

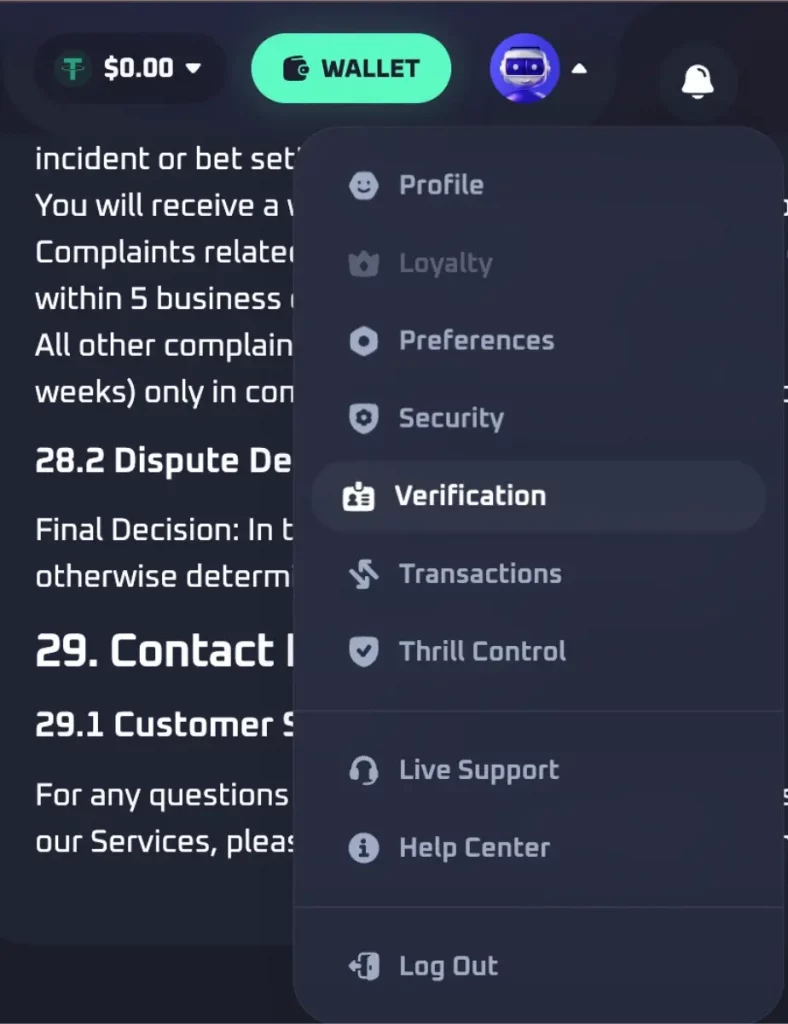

It does not explain each level on the site, and you will not see it in your profile menu. The process becomes stricter as you move through the levels.

Level 1: Personal details

The first level focuses on basic personal information that you’ll provide during account registration. Level 1 requires:

- First name

- Last name

- Date of birth

- Country of residence

- Full address

These details are the base for all future checks.

I strongly recommend double-checking all details before submitting, as changing this information later can trigger additional security checks.

Level 2: Identity verification

At this stage, you need to send one of the following:

- Passport

- National ID card

- Driver’s license

The copy must be clear and show your name, date of birth, and a visible photo. Both sides are required if the document has two sides.

Poor-quality images are the main reason for rejections.

Level 3: Address verification

The third verification level requires proof of address to confirm the residential information you provided in Level 1. Accepted documents are:

- Utility bill

- Bank statement

- Lease or rental agreement

- Letter from a government office

The document must be issued within the last six months and clearly display your name and the address you registered with.

Screenshots or digital copies are typically acceptable, but they must be clear and complete.

One thing I noticed about Thrill’s process is that the casinos don’t explicitly list all acceptable documents on the website, which can create tons of uncertainty for players.

When in doubt, contacting customer support before submitting can save time.

Level 4: Source of wealth

This is for high-value accounts or flagged activity. Thrill may request:

- Employment contract or payslips

- Proof of business ownership

- Bank statements showing income

- Investment portfolio statements

- Tax returns

- Inheritance documents

Processing can take longer here due to the amount of detail required. This level is usually for withdrawals over $10,000 or very large deposits in a short period.

Unless you raise some big flags, I really doubt you’ll ever be asked for Level 4 verification.

When KYC is triggered at Thrill Casino?

Thrill Casino’s terms give them broad discretion over when to request KYC verification, but several common triggers exist based on industry standards and their stated policies:

- Withdrawal requests are the most common trigger. While I successfully withdrew during early testing, current users report facing verification requests before their first withdrawal.

- Large transactions will almost certainly trigger KYC. While Thrill doesn’t specify exact thresholds, deposits or withdrawals over $2,000 will most likely trigger prompt verification requests.

- Suspicious activity patterns such as rapid deposits and withdrawals, unusual betting patterns, or logins from multiple locations can flag your account for review.

- Random compliance checks may occur as part of Thrill’s AML procedures, even for players with normal activity levels.

- An extended account inactivity followed by sudden large transactions often triggers additional scrutiny.

The casino also reserves the right to request verification based on third-party database checks or if it suspects any terms of service violations.

What happens if you do not complete KYC?

Not completing verification at Thrill Casino will quickly lead to restrictions.

The terms clearly state that KYC is mandatory when requested, and ignoring it will stop you from using key features of the site.

Here’s what you can expect if you do not comply:

- Account suspension

Once KYC is requested, your account will be frozen until the documents are provided and approved. You will not be able to deposit, place bets, or claim bonuses. - Blocked withdrawals

Any pending payouts will be placed on hold until your verification is complete. The money stays in your account but cannot be transferred out. - Account closure

Ignoring multiple requests or failing to provide acceptable documents can result in permanent closure. Thrill cites this as a security measure to prevent fraud and money laundering. - Potential fund forfeiture

If the casino believes fraudulent or forged documents have been used, they may confiscate funds. - Regulatory reporting

Serious cases can be reported to licensing authorities, which can lead to further consequences, including being banned from opening new accounts on the platform.

If your situation is legitimate and you eventually provide valid documents, Thrill will restore full account access and allow withdrawals.

Tips for faster verification

Getting verified at Thrill Casino is straightforward if you prepare in advance. Following these steps can speed up approval and help you avoid unnecessary delays.

- Match your details

Make sure your registration info is identical to your documents. - Use clear images

Avoid blur, glare, or cropped edges in your photos or scans. - Provide both sides

If your ID has two sides, submit both in full. - Keep documents recent

Proof of address must be issued within the last six months. - Respond quickly

Send the requested files as soon as possible to keep the process moving.

No-KYC alternatives to Thrill Casino

Final words

Thrill Casino’s KYC process is pretty standard for a licensed crypto casino.

The four-level system isn’t unreasonable, and from what I’ve seen, they’re not overly aggressive with small-time players.

If you’re okay with jumping through the usual KYC hoops and want a regulated platform, Thrill Casino won’t give you any nasty surprises. Just have your documents ready from day one.

But if privacy is your main concern? You might want to look elsewhere before putting serious money on the table.