Hidden side of regulation: how much do governments really earn from iGaming?

As the worldwide iGaming industry grows larger in scope and reach, it becomes evident that regulation encompasses more than rules; it also significantly impacts revenue.

Some nations with systems are transforming gambling into a steady revenue stream for the public purse; meanwhile, other countries are witnessing billions slipping away from their grasp.

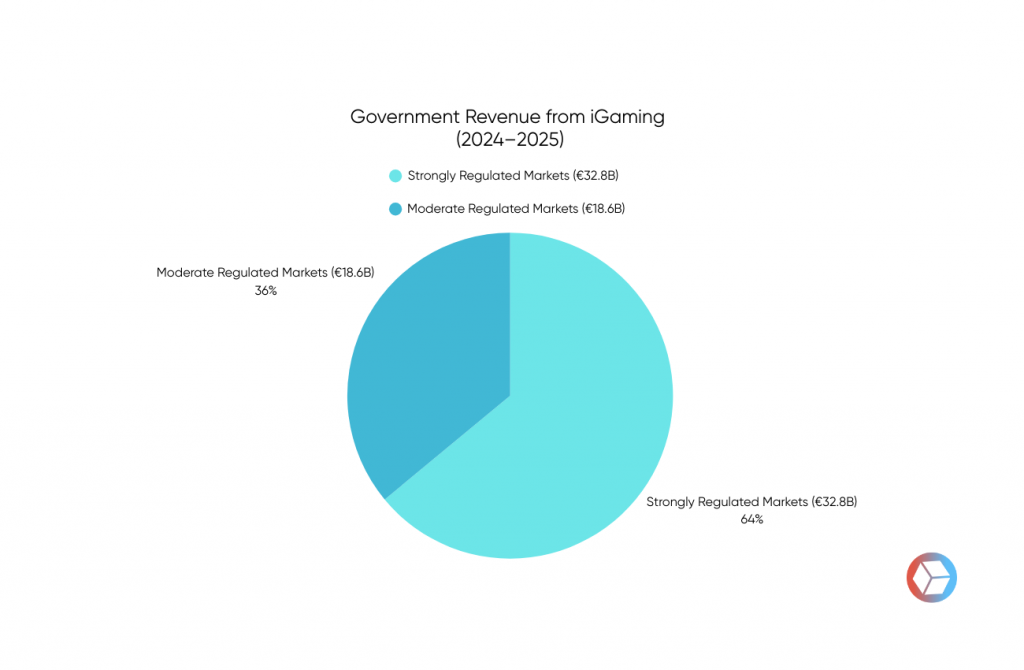

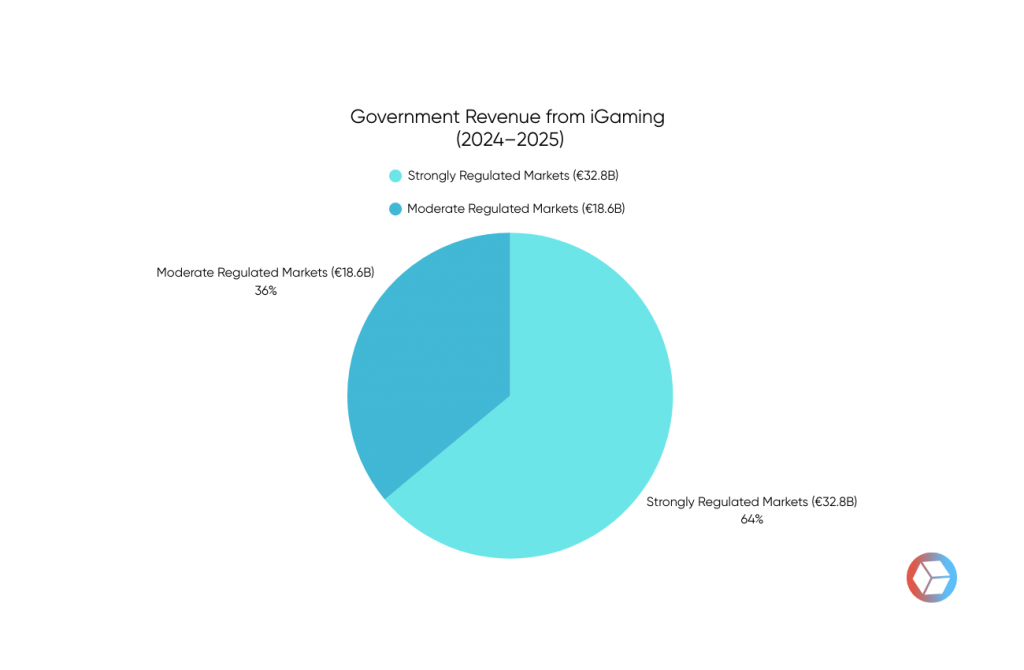

Key insights: strong vs. medium regulated markets (2024–2025)

- Governments always win when they regulate: iGaming delivers major public revenue, with €32.8B captured in strongly regulated markets vs. €18.6B in moderately regulated ones. Strong regulation secures nearly 2× more revenue, while loosely regulated systems see large tax losses as players move offshore

- Moderate bets bleed revenue: In moderate-regulated markets, such as Brazil, up to 73% of gambling activity happens on offshore platforms, far beyond government reach.

- Regulated systems keep users in, and taxed: Channelization rates hit 85%+ in strong in regulated markets, vs. <30% in loosely moderate-regulated ones.

- Crypto gambling regulation is still niche: Only Malta regulates crypto gambling, while others miss out, resulting in over €17B in lost annual revenue from untaxed offshore crypto play.

- Addiction is invisible without oversight: In strong regulated markets, us as the UK, 2.5% (UK-specific) of adults are identified as problem gamblers. In moderate ones, there’s often no data at all.

- Fraud drops when rules are enforced: After regulation, suspicious betting activity fell by 48%, while moderately regulated markets remain exposed to manipulation.

- Tough rules may slow growth, but not revenue: Strict ad bans cut new sign-ups by 55%, yet overall GGR continues to rise in strong-regulated markets.

- Licensing brings instant cash when structured right: Some strong markets raised €350M+ in fees; poorly designed tax models, like flat 50% GGR, drive operators away.

- Public pressure builds, but only strong markets act: Regulation turns public concern into real reform; moderate-regulated markets stall until crisis forces change.

Important clarification

Let’s clarify the language used in the report before getting into the statistics discussion. The term “markets” refers to countries with regulations for gambling, such as the UK with its licensing requirements and player protection measures, or Malta, which closely monitors even cryptocurrency gambling activities.

In countries such as Brazil, markets are considered regulated as they continuously update their regulations to address matters such as operations and various state rules regarding the use of cryptocurrency.

The revenue divide: who gets paid – and who misses out

Strongly regulated iGaming markets are paying off, literally. Governments in countries with licensing frameworks, taxation models, and compliance requirements are pulling in billions each year.

From €21.6B GGR in Italy’s fully regulated market to £3.6B in UK gambling duties (2024/25), the financial return is clear.

Meanwhile, moderate-regulated or delayed markets like Brazil lose out: Brazil alone forfeited ~$2B in 2024 to offshore operators.

This difference isn’t just about tax percentages – it’s about structure. Where regulation is clear and enforced, governments capture most of the GGR.

Where it’s vague, delayed, or overly restrictive, players flee to offshore options.

As the chart shows, strongly regulated markets like Italy and the UK capture around 61% of total iGaming revenue, while moderately regulated markets such as Brazil account for just 39%- underlining how full regulation nearly doubles government returns.

The сrypto layer: who regulates blockchain gambling – and who loses out?

Operating within a gray area worldwide is something crypto casinos face; this uncertainty results in significant financial losses for governments around the globe. Among the nations examined for regulation in this sector of gambling activities, Malta stands out as the sole country that issues licenses for crypto gambling within a clear-cut framework.

In regions worldwide and even in highly regulated traditional markets where fiat currencies dominate the scene, cryptocurrency still faces bans or limitations or simply gets overlooked altogether for various reasons.

For an in-depth exploration of the approaches different nations take on this matter, check out the comprehensive review on the global status of cryptocurrency gambling at worldwide crypto gambling status.

| Country | Crypto Casino Regulation | Government Revenue from Crypto Gambling |

|---|---|---|

| Italy | Not allowed | Allowed with a UKGC license, rare |

| UK | Allowed with UKGC license, rare | Minimal, very few licensed operators accept crypto |

| Sweden | Not allowed | €0 , Crypto use is banned |

| Ontario | Not officially supported | €0 , Licensed platforms use fiat only |

| Brazil | Not allowed (2025 law excludes crypto) | €0, Estimated ~$2B lost offshore (includes crypto) |

| Malta | Licensed and regulated | Some revenue earned, but crypto share of tax base not publicly disclosed |

Addiction: tracked in one market, ignored in another

Strongly regulated markets monitor gambling harm – and the data is sobering. A 2024–25 UK survey found 2.5% of adults are problem gamblers, affecting more than 1.3 million people.

Over 532,000 users self-excluded via GamStop, with an uptick among under-25s. These numbers are driving reforms, from affordability checks to operator levies for addiction treatment.

In lightly regulated markets, there’s often no data at all. Brazil had no official tracking until its 2025 regulation rollout. That means no oversight of risk patterns, no early intervention, and no public health planning – a dangerous blind spot in an industry built on psychological hooks.

Crime & match-fixing: what happens without oversight

A match-fixing scandal rocked Brazil’s football leagues in 2023. Bribery, unreported bets, and fraud went unchecked in the country’s then-unregulated betting sector. After the regulation kicked in, match-fixing alerts dropped 48% in a single year.

Similarly, Malta had to overhaul its anti-money laundering controls after being greylisted by FATF in 2021 – a wake-up call for its iGaming hub.

Medium regulation creates loopholes – and criminals know it. Without robust enforcement, unlicensed operators become havens for money laundering, tax evasion, and manipulation.

Marketing, compliance, and political pressure

Strongly regulated markets face growing political scrutiny, but that scrutiny often creates smarter, safer systems.

Spain and Italy imposed strict ad bans, and the UK introduced a statutory levy on operators. These changes may reduce user acquisition in the short term.

Spain recorded a 55% drop in new gambling accounts, but players kept returning and overall GGR kept rising, proving that trust matters more than first clicks.

In moderately regulated markets, public pressure builds but rarely drives action.

In Brazil, 65% of citizens supported tighter controls in 2024, and only then did the government implement ID checks, domain requirements, and enforcement mechanisms.

Compliance costs and market stability

Yes, regulation is expensive. In markets like structured ones, operators invest in licenses and audits, for security and user protection, while also benefiting from long-term stability; an example is Italy generating a substantial €350 million solely from licensing fees in 2025.

By contrast, in moderate-regulated markets, unclear tax rules and late enforcement can drive operators away, or into grey market strategies.

That instability hurts everyone: governments lose revenue, users face fewer protections, and brands dilute trust. The long game belongs to regulators who build sustainable ecosystems, not temporary booms.

Conclusion: strong regulation wins in revenue, safety, and control

In 2025, one message is clear: strong regulation works. Governments earn more. Players are safer. Crime is reduced. And even when growth slows, stability increases.

Moderate regulation might accelerate early market activity, but it also opens the door to tax losses, fraud, addiction, and eventual backlash.

Markets that win, in fiscal terms and in social outcomes, are the ones that regulate early, regulate smart, and adapt fast. That’s the real bottom line.

Disclaimer: All content on this website is for informational purposes only and does not constitute legal or financial advice.