Jackpotter KYC: Verification-free or not exactly?

KYC checks have become one of the most debated topics in crypto casinos, and Jackpotter is no exception.

If you’re considering Jackpotter, it’s worth understanding exactly when verification might be required, how the process works, and what you can do to make it as smooth as possible.

🔑 Key Takeaways

- Jackpotter doesn’t require KYC by default, but large withdrawals or flagged accounts can trigger it.

- The site uses a three-level verification system, starting with basic details and scaling up to full ID and address confirmation.

- Withdrawals above $1,000 may require verification, as outlined in the T&Cs.

- Completing higher verification levels unlocks bonuses, faster withdrawals, and extra security.

Does Jackpotter ask for KYC?

The short answer: usually not. You can register, deposit, and withdraw smaller amounts without needing to upload documents.

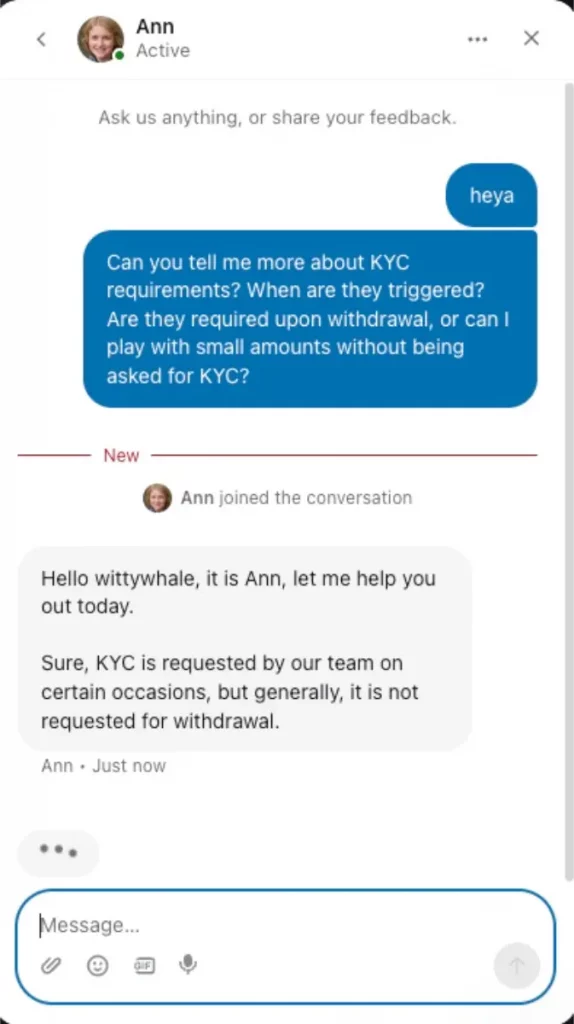

I even confirmed with a live support agent that KYC isn’t mandatory in most cases.

That said, Jackpotter’s Terms and Conditions tell a slightly different story.

Section 8.8.3 states that any withdrawal request over $1,000 USD (or equivalent) may require identity verification.

It can include uploading a passport, ID card, or driver’s license, sometimes with an additional selfie for confirmation.

The operator also reserves the right to request extra documents if suspicious activity is detected.

So, while you’ll often enjoy a near-anonymous experience, you should be prepared: once you start cashing out bigger wins, Jackpotter may ask for KYC.

In my view, this is a fair trade-off.

It’s not as strict as casinos that demand full verification upfront, but it’s also not entirely no-KYC.

Verification levels at Jackpotter

Jackpotter uses a three-tier verification system, giving you flexibility in how far you want to go.

Each level unlocks different features, and higher levels are tied to both account safety and bonus eligibility.

Here’s how it breaks down:

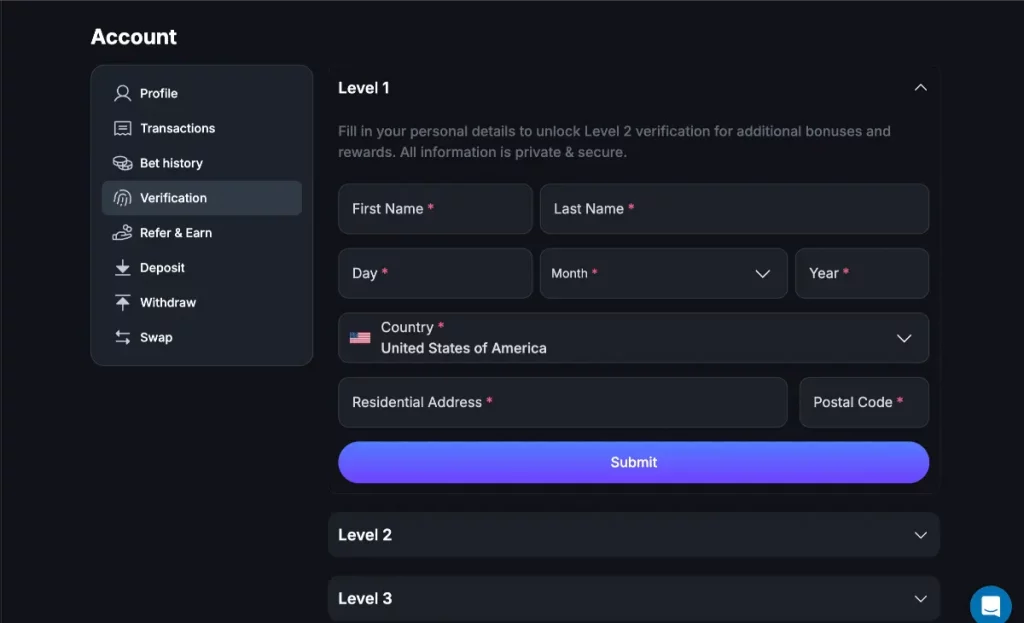

Level 1 – Basic Details

At registration, you can jump straight into gameplay without heavy checks.

Level 1 simply requires personal info:

- First and last name

- Date of birth

- Country and residential address

- Postal code

This information is stored securely and is mainly there to align with AML requirements.

For those who are new to crypto casinos, Stake KYC asks you to provide level 2 before the first deposit.

I can safely say that Jackpotter is one of the “easier KYC’s”.

Level 2 – Identity Verification

It is required if you deposit or withdraw over 2,000 USDT.

Here, it’s similar to Roobet’s KYC, though Roobet asks way earlier.

At this stage, you’ll need to provide:

- A valid government-issued ID (passport, driver’s license, or ID card)

- A selfie holding the ID alongside a six-digit code generated by Jackpotter

- Electronic verification to confirm details match

If the automated system fails, you may also need to submit a certificate of residence or another proof-of-address document.

Level 3 – Address Verification

The strictest level, often tied to high withdrawals or bonus eligibility (like the 50 free spins no-deposit reward). You’ll need:

- A recent utility bill, bank statement, or government-issued document (less than 12 months old)

- Full name, address, and date of issue clearly shown

- Documents submitted as original photos, not screenshots

This level adds the final security layer and ensures you can withdraw larger amounts without issues.

Can you bypass Jackpotter verification?

Sometimes, but don’t count on it. In practice, you’ll often play and cash out small amounts without full KYC: Jackpotter only forces ID checks for flagged activity or larger withdrawals (the T&Cs mention thresholds like $1,000+ and stricter checks above other bands).

If you keep deposits/withdrawals small and avoid anything that looks like bonus abuse or unusual patterns, you may never be asked for documents.

That said, the operator clearly reserves the right to request verification at any time, and if you try to “game” the system (fake docs, multiple accounts, suspicious betting patterns), you’ll trigger checks fast.

My advice: play within the stated limits, keep your profile details consistent, and be ready to complete Level 2/3 when you want to cash out proper wins.

It’s safer and faster than trying to bypass verification.

How to pass Jackpotter verification?

The KYC process at Jackpotter isn’t complicated, but it does require clean documents and careful uploads.

If you follow the steps correctly, approval usually happens within a few hours to a couple of days, depending on the level.

Here’s how to do it in a few steps:

- Log in and go to the Verification tab in your account settings.

- Complete Level 1 by filling in your name, birth date, country, and residential address.

- Upload your ID for Level 2 (passport, driver’s license, or national ID card) and take a selfie with the code provided.

- Submit proof of address for Level 3 (utility bill, bank statement, or government-issued letter less than 3 months old).

- Wait for approval – you’ll get a notification once your documents are verified.

Tips for passing Jackpotter KYC

Verification doesn’t have to be stressful. If you prepare your documents correctly, Jackpotter’s checks are usually smooth and fast. Here are a few simple tips to make sure your approval isn’t delayed:

- Use valid, government-issued documents (passport, driver’s license, or national ID).

- Avoid blurry photos or screenshots – only original, well-lit images are accepted.

- Make sure your name and address match the details in your profile.

- Submit recent proof of address (issued within the last 12 months).

- Contact live chat if your upload fails or if verification takes longer than expected.

Final words

KYC at Jackpotter strikes a balance between privacy and compliance.

Most players will enjoy a nearly anonymous experience – deposits, gameplay, and even smaller withdrawals rarely trigger verification.

Still, the Terms & Conditions make it clear: once you start moving larger sums or hit a flagged pattern, expect to complete Levels 2 or 3.

It’s lighter than platforms that demand ID upfront, but not as loose as the rare “no-KYC forever” operators.