Gamified retention: How do crypto casinos incentivize loyalty?

Player loyalty is now one of the biggest battlegrounds in the crypto casino industry.

Operators fight to keep players coming back. That’s why welcome bonuses, VIP programs, cashback, and gamified rewards have become essential parts of the playbook.

And the numbers show just how much weight these tools carry.

🔑 Key Takeaways

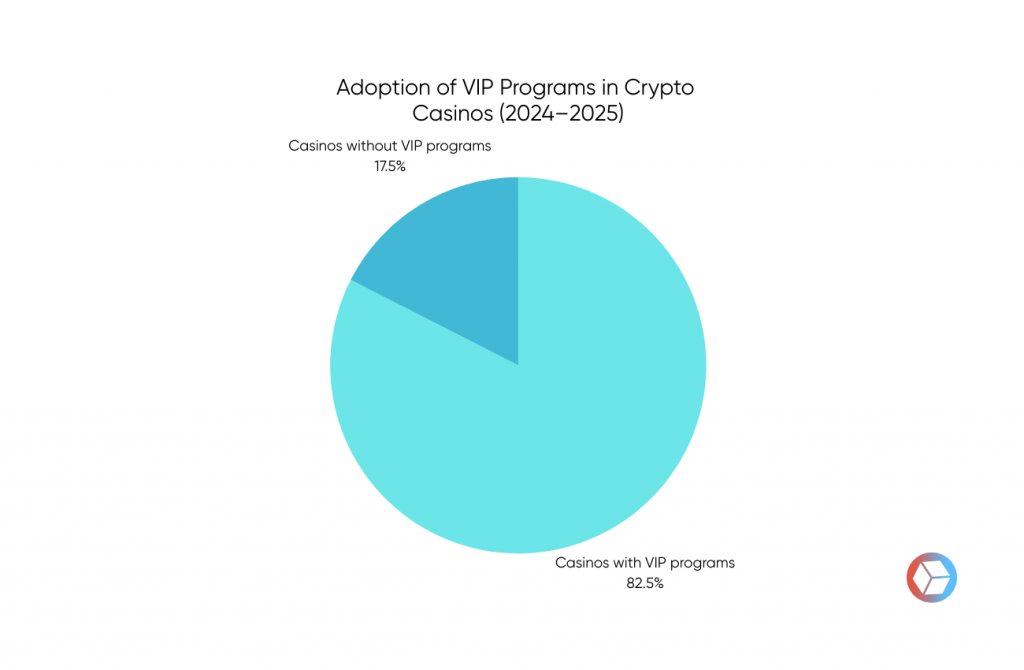

- 82.5% of crypto casinos run VIP programs – loyalty ladders are the new standard.

- The market hit $81.4B GGR in 2024, proving how much is at stake.

- Cashback appears in 53.8% of casinos, rakeback in 36.5%, with 14% combining both.

- Cashback averages 22.9%, rakeback 31.4% and whales chase the bigger cut.

- VIP structures vary from 5 to 20+ tiers, with top ranks offering 25% cashback + 25% rakeback daily.

- 73.4% of casinos still use welcome bonuses, but retention clearly outweighs acquisition.

- 54.7% stick to cash-only deals, while free spins show up in just 18.8%.

- No-deposit offers remain rare, with only 14.1% of casinos providing them.

- The average welcome bonus is $20,965, but the median sits at $2,000 — the huge promises are the exception, not the rule.

VIP Programs are the new loyalty standard

VIP programs have become the backbone of crypto casinos.

Out of 63 platforms we reviewed, 52 run structured VIP or loyalty programs – or more than 80% of the market.

The model is familiar: climb through levels, unlock perks, and get more personal treatment as you rise.

What started as a way to stand out is now a baseline requirement.

In today’s market, a crypto casino without a VIP ladder is at a huge competitive disadvantage.

Cashback vs rakeback: Which reigns supreme?

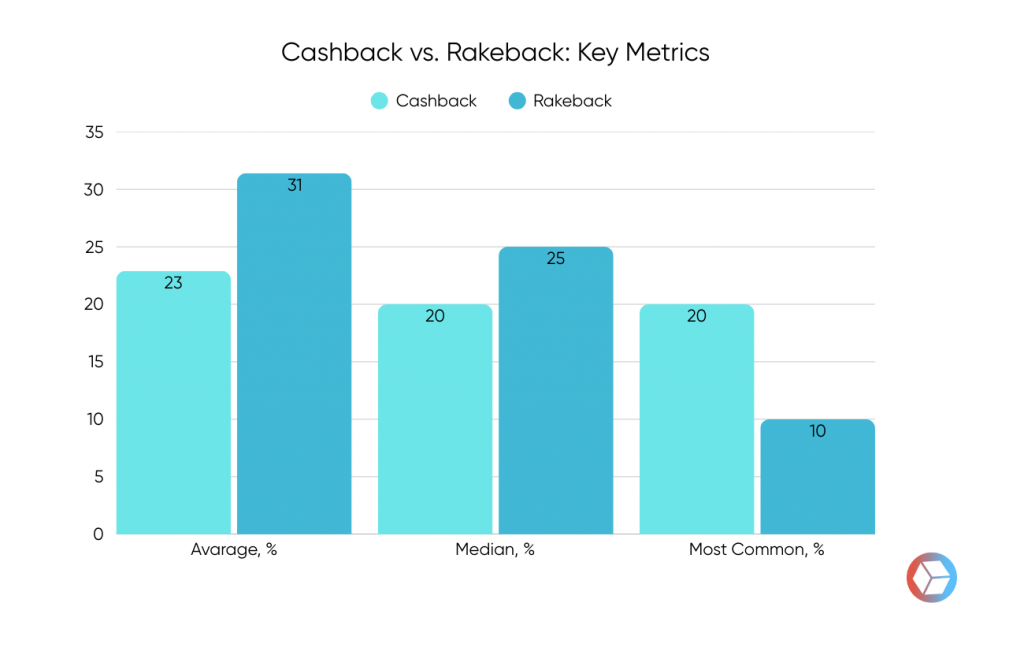

It’s no surprise that crypto casino cashbacks are the most common loyalty perk, showing up in 53.8% of casinos, while rakeback is less frequent at 36.5%.

But here’s an interesting twist: rakeback usually pays more.

Here are the numbers.

| Metric | Cashback | Rakeback |

|---|---|---|

| Average | 22.9% | 31.4% |

| Median | 20% | 25% |

| Most common value | 20% | 10% |

Casual players stick to cashback for predictability, while high-volume bettors could chase rakeback’s higher cut.

Casinos that have both usually win on retention.

Tiered progression

Tier systems are the backbone of VIP programs. Most casinos build 5–7 levels (Bronze to Diamond being the classic), while others stretch to 10, 15, or even 20+ ranks to keep players grinding.

The design is simple but effective: there’s always another level just ahead, which keeps players motivated to wager more and unlock better rewards.

Welcome bonuses – still widespread, but secondary

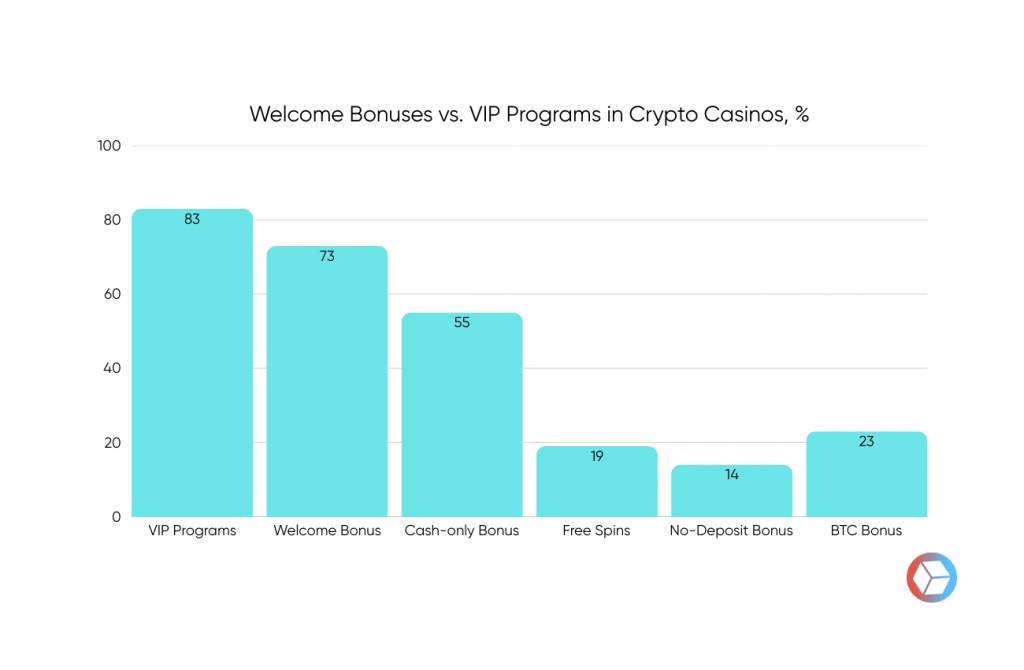

Welcome packages are still a big part of crypto casinos, but they don’t carry the same weight as loyalty programs.

Around 73.4% of operators run a welcome bonus, compared to the 82.5% that invest in VIP systems.

The numbers alone show where the focus lies – retention has overtaken acquisition.

Cash deals dominate these offers. More than half of casinos (54.7%) rely on straightforward cash packages, while free spins appear in fewer than one in five cases (18.8%).

No-deposit bonuses are even rarer, offered by just 14.1% of casinos – and none come as free chips.

Sizes for the welcome bonuses are all over the place.

The average sits at a massive $20,965, but the median is just $2,000, which means the big numbers are driven by a handful of oversized offers, like BC.Game’s $220K welcome package.

BTC bonuses follow the same trend: an average of 1.29 BTC, but a median of 1 BTC.

Only about a quarter of casinos (24.3%) promote BTC packages, with most sticking to USD or stablecoins.

Operators here put more resources into long-term loyalty ladders than one-time acquisition hooks – and that says a lot about where the profitability really comes from.

“Whale Treament” or how big spenders are rewarded

Whales, the small group of high-value players, remains the backbone of casino revenue.

A tiny percentage of users generates a disproportionate share of profits, which is why loyalty programs are designed with them in mind.

To retain these players, operators provide personalized account management, custom bonuses, and faster service.

In some cases, casinos go further by offering event invitations, luxury gifts, or one-on-one deals.

Rakebit illustrates the extreme, with its top-tier players receiving 25% cashback and 25% rakeback.

Frequency – or how platforms build habits through rewards

The timing of rewards is just as important as the percentage offered.

Some casinos deliver daily cashback to encourage frequent logins and repeated play.

Others emphasize weekly bonuses, which create anticipation and strengthen mid-term retention.

Monthly loyalty payouts remain popular as well, serving as larger anchor rewards that incentivize consistent activity.

Many operators now combine all three approaches so that players can stay engaged both short-term and long-term.

A recap

Loyalty programs are more than marketing tools – they are essential for protecting revenue. Cashback cushions losses and extends playtime, which reduces churn and increases lifetime value.

Because acquiring a new player costs substantially more than retaining an existing one, operators focus heavily on keeping whales satisfied.

Studies from 2024-25 showed that VIPs and whales together contribute the majority of casino revenue.

For this reason, loyalty budgets have grown into one of the most strategic investments in the crypto gambling sector.