Bitcoin Spread Betting: Here’s Everything You Need to Know

Crypto trading often feels like gambling—volatile markets, high stakes, and emotional swings. But Bitcoin spread betting takes it a step further. You’re not buying or selling actual BTC; you’re betting on its price direction, much like placing a wager on a roulette spin.

The appeal? In some countries, you can profit from Bitcoin gambling without paying tax, since it’s treated as betting, not investing, though the loopholes are closing now.

It’s fast but high-risk—if you know what you’re doing and live where it’s legal. In this guide, we break down exactly how it works, where it’s allowed, and whether it’s worth the risk.

What is Bitcoin Spread Betting?

Bitcoin spread betting is a way to speculate on the price of Bitcoin without actually buying or selling the cryptocurrency. You simply take a position on whether you think the price will go up or down, and if your prediction is correct, you will make a profit.

You don’t own the BTC—you simply bet on the movement of the market.

With this strategy, a derivatives contract is used which allows you to bet on the price without taking physical possession. It’s much like the crash casino game—it goes up and up, until it falters.

The obvious advantage here is you don’t have to worry about storing or safeguarding your Bitcoin, as you would if you owned the cryptocurrency outright.

And since it’s considered crypto gambling—you don’t owe taxes (unless you owe gambling taxes).

How Spread Betting on Cryptocurrency Can Make You Money

The basic premise of spread betting is not that much different than actual gambling.

You have an event you’re betting on (the price of Bitcoin) and a “stake” (the amount of money you’re willing to risk). If the event happens the way you predicted, you win the bet and earn a profit. If it doesn’t, you lose your stake.

Say the crypto moves three points. You gain or lose a multiple of three.

What does this mean? We’re talking about a leveraged bet.

This is what makes spread betting on cryptocurrency an exciting option for many traders. You really only need to deposit a tiny fraction of the trade value to participate in spread betting.

The benefit of leverage

With just a small amount, you can control a much larger position and make a significant profit.

And, while this can give you some handsome gains, it also means your losses can add up just as quickly if you’re wrong about the market.

Is Spread Betting on Bitcoin Legal?

Quick answer: it depends.

The legality of Bitcoin spread betting depends entirely on your location. In the UK, retail traders are banned from spread betting on crypto—since 2021, the FCA prohibits the sale of crypto derivatives to retail clients.

The US, Japan, and Australia also outlaw crypto spread betting. However, some EU countries still permit it, and professional clients in certain regions may retain access.

It’s more or less considered crypto gambling, but with a financial instrument.

Bitcoin Spread Betting: Pros & Cons

Bitcoin spread betting can be a fast, flexible way to speculate on BTC’s price without owning any coins. But while the potential upside is appealing, the risks are equally serious—especially with leverage involved.

Pros

- Tax advantages in some countries where profits are treated as gambling winnings

- No need to own Bitcoin or worry about wallets and security

- Leverage potential allows large exposure from a small deposit

- Profit from any direction—you can bet on price going up or down

Cons

❌ Unregulated brokers can expose you to fraud or unfair practices

❌ Even a 5% correction can wipe you out with leverage

❌ Not legal in many major markets

And, of course, you don’t have to think about setting up a Bitcoin wallet or dealing with the complexities of buying and selling Bitcoin directly. The spread bet exposes you to the potential gains from major market swings without the hassle of actually owning any Bitcoin.

Final Thoughts

Bitcoin spread betting takes crypto speculation and cranks it up a notch.

It’s not just trading—it’s gambling on Bitcoin’s price without owning a single sat. In some countries, that means it’s even tax-free.

Sounds great? Sure, but here’s the catch: the risks are massive.

Leverage and BTC volatility don’t play nice, and it’s not even legal in major markets like the UK. So, unless you’re based somewhere that allows it, this isn’t an option. And even if it is, proceed with caution—always use a licensed broker, understand the rules, and don’t stake more than you can afford to lose.

If that sounds like too much, stick to safer ways to play the crypto game—like standard crypto games.

Latest News

July 2, 2025

5 Sites Like Ybets That We Love in 2025If you’re looking for multi-tier bonuses, Ybets is a great destination, without a doubt. But it’s not without its limitations. If you’re looking for alternatives to shake things up, you’ve come to the right place. Ybets Cons ❌ Monthly withdrawal cap of $10K for non-VIPs❌ No in-house original games❌ Higher minimum withdrawals than competitors Whether […]

July 2, 2025

Ybets KYC: Can You Play Anonymously?If you’re looking for great bonuses, a superb game library, and low minimum deposits, Ybets is a top place to be. But what about KYC? Here’s the good news: Ybets is among the more lenient casinos when it comes to identity checks. You can usually deposit, play, and even withdraw small amounts without needing to […]

July 1, 2025

Best Crypto Casinos Like Lucky Block (and Better)Since its establishment in early 2022, Lucky Block Casino has gathered quite a player base—and it’s easy to see why. A more than generous welcome bonus, special gambling token, and plenty promotions are just a few perks the platform has up its sleeve. But it’s not all sunshine and roses: Lucky Block Cons ❌ Monthly max. […]

July 1, 2025

Betpanda KYC Guide 2025: No-KYC Withdrawals & When Verification AppliesMany players see Betpanda as a great option for having fun without going through detailed KYC checks. But I have tested dozens of crypto casinos, and believe me, claims and truths might be two completely different terms. That’s why I’ll answer the question in this post. Betpanda markets itself as a no-KYC anonymous casino. Indeed, […]

July 1, 2025

Shuffle KYC Guide 2025: What to Expect Before Cashing OutIf you’ve been seeking top crypto casinos, then Shuffle has definitely caught your attention at least once. It’s know for its fast gameplay, in-house titles, and the tempting $100K daily races. But for many players, the real question isn’t about games—it’s about KYC. Do you really need to verify your identity to play or withdraw? […]

June 30, 2025

What Is the Best Crypto Casino Cashback Bonus? Top 5 OptionsLooking for a crypto casino Cashback that gives you the most bang for your buck? In this article, I’ll break down the top four cashback bonuses of 2025, so you can win back more while you play. Let’s dive in and find out which offers and Cashback casinos are really worth your time. 🔑 Key […]

June 26, 2025

Best Crypto Welcome Bonuses: 2025 GuideSo, you’re hunting for the best crypto casino welcome bonus out there? I’ve been there — and I can tell you now, not all bonuses are worth your time. Some look huge on paper, but come with brutal wagering requirements. Others are surprisingly generous, but fly under the radar. That’s why I put together this […]

June 26, 2025

Biggest Gambling and Crypto Events in 2025Crypto and gambling have never been more intertwined—and 2025 is set to take things even further. The year is packed with must-attend events for anyone involved in gambling with cryptocurrencies—whether you’re an affiliate, operator, or deep into the Web3 side of things. So here’s what’s worth marking on your calendar: the key conferences, expos, and […]

June 26, 2025

20+ Amazing Bitcoin Casino StatisticsBitcoin casinos are one of the latest trends in the online gambling industry and may shape the future of online gambling as we know it. With so many advantages over traditional casinos, such as faster payments, more games, and bigger bonuses, some of the best Bitcoin casinos in the market already have thousands of active […]

June 26, 2025

BitStarz KYCBitStarz Casino might be the crown jewel in Dama NV’s portfolio—but is it actually worth your time? For many crypto players, the big question isn’t just about bonuses or games. It’s whether you’ll get hit with a KYC check when you try to cash out. I’ve seen a lot of “no-KYC” claims fall apart the […]

June 25, 2025

Cloudbet KYC Guide 2025: Everything You Need to Know Before You PlayI’ve tested enough crypto casinos to know that “no KYC” can mean very different things in practice. Cloudbet seems to be a good option for players who want a bit of anonymity—at least up to a point. But what’s the reality behind their daily withdrawal limit and ID checks? In this guide, I’ll walk you […]

June 24, 2025

5 Sites Like Roobet (and Better) That We Love in 2025Roobet is a safe and well-loved crypto casino, a staple for many gambling enthusiasts. But, it’s not available everywhere—and it’s not without its downsides. Roobet Cons ❌ No welcome bonus❌ Strict KYC before withdrawal❌ Restricted in many regions Not to worry, though, there’s some good news! We’ve got you covered with the top five gambling […]

June 24, 2025

Reel Rivals - Round 2 - (25.6 - 9.7)Welcome to Reel Rivals, the ultimate battle of luck, skill, and strategy! Outplay your rivals in this high-stakes mini-challenge and climb the leaderboard to claim those sweet, sweet experience points, which can earn you up to $10 every 2 weeks just by playing games on this page. Prizes for Round 1 🥇 5000 XP🥈 2500 […]

June 24, 2025

MetaMask Casinos: The Ultimate Guide to MetaMask GamblingMetaMask is one of the most popular crypto wallets worldwide in 2025, and it continues to be the go-to option for many crypto gamblers. But why is that? I looked far and wide for the best MetaMask casinos and finally have some top picks. Excited to get started already? Here’s an overview of my favorite […]

June 24, 2025

Best Casinos Supporting Wallet ConnectWant to skip the email sign-up and jump straight into the action? Wallet Connect is one of the crypto wallets that make this happen. It lets you log in, deposit, and withdraw directly from your crypto wallet. Let’s find out which crypto casinos support it and whether it’s a worthy rival of MetaMask for gambling. […]

June 23, 2025

Bitcoin vs Tether: Are Larger Bonuses Worth The Risk?Bonuses worth up to 1 BTC sound great on paper—after all, that’s well over $100K during a bull run. But for many, gambling is already risky enough without their deposit value changing overnight. That’s where Tether casinos step in. I’ll compare BTC vs USDT for crypto casino bonuses, deposits, and overall experience—so you can choose what […]

June 23, 2025

How MiCA Will Impact USDC Gambling in the EU?I’ve been fielding the same question for weeks: “Is my favorite stablecoin about to vanish from European casinos?” Short answer? If you’re married to USDT, you might feel the squeeze, but if you’re happy swapping chips for USDC, MiCA just rolled out the red carpet. Below, I’ll dig into what MiCA really says, why USDT […]

June 23, 2025

The Impact of Regulation on Crypto Casinos and PlayersCrypto casinos have always had a certain allure—increased privacy, faster transactions, and better accessibility. For years, they stood apart from traditional online casinos by operating in a largely unregulated space. However, times are changing. Governments and regulatory bodies worldwide are tightening their grip on the crypto sector, and casinos are no exception. This raises an […]

June 23, 2025

Is Europe Really Banning Tether? What MiCA Means for EU Crypto Casino PlayersThe global crypto market is worth north of $250 million, and a big chunk is attributed to Europe. But things are about to get messy. Tether (USDT), the go-to stablecoin for many players, isn’t officially banned… but it might as well be. In this piece, I’ll walk you through what’s changing, when it’s happening, and […]

June 19, 2025

ERC-20 vs TRC-20: Which Is Better For Your Coins?Tether may be already rivaling Bitcoin, but many forget one factor: not all blockchains are created equal. While ERC-20 is the old-school favorite, TRC-20 used to dominate for cheap Tether deposits—until things started to shift. Is the cheaper option still the smarter one? Let’s break it down. 🔑 Key Takeaways While both networks support Tether […]

June 19, 2025

ERC-20 Casinos: Where to Gamble with Ethereum-Based TokensLooking to use your Ethereum or USDT for casino play? You’re not the only one. Most crypto gamblers already have ERC-20 tokens in their wallets, and many of the best casinos support them. But which platforms actually make it easy—and cheap—to use ERC-20 for gambling? I tested dozens of sites and tokens to find out […]

June 19, 2025

Ethereum Fees Surge Upon 63% Price Increase: What It Means for Crypto GamblingEthereum’s had one hell of a run—up 63% in just a month and trading around the $2,600 mark. But while ETH holders are cheering, gamblers are gritting their teeth. Why? Because gas fees have spiked, too. Right now, a single transaction will set you back around $1.60, and that hits everyone gambling with Ethereum and […]

June 19, 2025

Casino Coins by Market Cap – Are Bigger Tokens Better?When you’re gambling with crypto, the size of a coin’s market cap can feel like it matters—but does it really? Is Bitcoin better than Solana just because it’s worth more? Or are casino-friendly features like speed and fees more important than price tags? Let’s break it down. With over 60% of the total crypto market […]

June 19, 2025

BEP-20 Casino Sites: Where to Gamble with Binance Smart Chain TokensBEP-20 is the token standard for Binance Smart Chain—basically BSC’s version of Ethereum’s ERC-20. It powers a growing number of fast, low-cost crypto transactions, making it ideal for gambling. If you’re tired of slow confirmations and high gas fees, BEP-20 casino sites are a solid alternative. So, which casinos actually support the Binance Smart Chain? […]

June 19, 2025

ERC-20 vs SPL-20: Which Network Is Better?When it comes to moving money around in crypto casinos, not all token standards are created equal. If you’ve played at even a handful of sites, you’ve probably noticed ERC-20 mentioned everywhere. ERC-20, built on Ethereum, is the standard—trusted, familiar, and nearly everywhere. But SPL-20, meanwhile, is Solana’s answer to fast, cheap transactions. But is […]

June 19, 2025

Best Crypto Casino Bonuses: June 2025Looking for the best casino deals right now? This page features hand-picked bonuses from our top casino partners and includes welcome offers, free spins, cashback, and tournaments. All in one place. We update the list regularly, so you can skip the research and jump straight into the action with the hottest offers. Stay in the […]

June 18, 2025

Hi Immerion!This page is published to verify the ownership of Casinocblockchain. Date: 18th June 2025.

June 17, 2025

USDT vs USDC for Gambling: Which Stablecoin Wins?Thinking of gambling with stablecoins but can’t decide between USDT and USDC? You’re not alone—I’ve juggled both across dozens of casinos. TRC-20, ERC-20, L2s… the whole thing can get messy fast. Here’s what actually matters when picking your gambling coin. 🔑 Key Takeaways USDT ban in Europe may be on the horizon, but here’s what’s […]

June 17, 2025

Bitcoin vs Litecoin: Is The “Digital Silver” Good For Gambling?Bitcoin might be the king of crypto, but Litecoin—often dubbed “digital silver”—still has a loyal following, especially among crypto casino players. It’s fast, cheap to use, and accepted by a surprising number of Litecoin casino sites. While it may not be as hyped as BTC or ETH these days, Litecoin has quietly remained one of […]

June 16, 2025

Thrill Casino Opens Doors In July: Ready To Be Excited?Thrill Casino hasn’t even switched on the lobby lights, yet hype is already building fast. A pre-launch waiting list is live, and hundreds of early birds have rushed to reserve a seat, keen to test-drive everything from instant crypto deposits to a brand-new rewards program. Word is the team will open the doors in July, […]

June 13, 2025

How to Choose Crypto Casinos for Your Gaming PreferencesChoosing a crypto casino isn’t just about grabbing the biggest bonus or picking the one with the most coins. If the games don’t fit your vibe, the withdrawals take forever, or support ghosts you when something breaks—what’s the point? In this guide, I’ll walk you through how to find a crypto casino that actually works […]

June 12, 2025

Best Bitcoin Wallet for Online Gambling — Our Top PicksLooking to bet with Bitcoin or other cryptocurrencies for gambling? You’ll need a secure wallet to keep your crypto. But how do you even choose one? In this article, I’ll help you choose the best crypto wallet for online gambling. Read on to learn about: Let’s jump right in: In a time crunch? I won’t […]

June 12, 2025

How to Practice Wallet Hygiene When Gambling With Crypto?Wallet hygiene sounds technical, but it’s dead simple—it’s how you manage your wallets to protect your privacy, avoid compliance issues, and keep your funds safe. In 2025, casinos and exchanges are using powerful tools to track where your crypto’s been. If your wallet’s tied to flagged activity (even accidentally), you could end up with delayed […]

June 12, 2025

Worldwide Crash Gambling Legality: A Complete Guide for 2025Since its emergence in 2014, crash gambling has stood out for its unique blend of excitement and uncertainty. We’ve joined powers on this crash gambling legality overview with Tecpinion, an iGaming software development studio known for creating engaging crash games and partnering with more than 50 casino brands all around the world. Tecpinion are true […]

June 11, 2025

Crash Gambling Odds Calculator: Discover Your Chances of WinningThis million-dollar question is on the mind of every enthusiastic crash gambler. The short answer? There is no magic crash gambling formula or life hack. But what we can offer is some realistic advice and guidance to understand the odds of a crash game better. 🔑 Key takeaways: Before we dive deeper into the topic at […]

June 11, 2025

Ethereum vs Tether: Which is Better for Gambling with ERC-20 Tokens?Most crypto casinos support both Ethereum and Tether (USDT), especially if they run on the Ethereum network. But what’s the better choice when you’re placing real-money bets? While Ethereum offers flexibility and decentralization, Tether keeps your bankroll stable—so the answer depends on how you play. Below, I’ll break down when to pick one over the […]

June 10, 2025

Mastering Wagering Requirements: A GuideThose crypto casino bonuses can be pretty tempting. But just like their non-crypto siblings, these bonuses come with a catch: wagering requirements. There’s no such thing as a free lunch, and like the fine print on any deal, rollover requirements can be a bit of a head-scratcher. I’ve been treading these waters for a long […]

June 10, 2025

USDT Ban: A Guide for Crypto GamblersFollowing the potential Tether ban in Europe, some big exchanges made a big move—swapping all USDT holdings for USDD or removing most Tether trading options for EU users. On the surface, this might look like just another regulatory shuffle. But for crypto gamblers who use popular exchanges like Binance to fund their casino sessions, it […]

June 10, 2025

How Much Do Crypto Casinos Really Make?Have you ever wondered how much money crypto casinos actually make? Spoiler alert: it’s not pocket change. The online casino market is expected to hit a staggering $245.5 billion in 2025—and crypto casinos are taking a fatter slice of that pie every year. But where’s all that money really coming from—and who’s profiting the most? […]

June 6, 2025

Roobet KYC: Everything You Need to KnowRoobet has carved out a solid spot as a fun and user-friendly crypto casino. But if there’s one thing that tends to ruffle feathers, it’s Roobet’s strict KYC policy. Whether you’re new to Roobet or a longtime player looking to cash out your winnings, KYC is a hurdle you’ll have to face. I’ll walk you […]

June 6, 2025

Online & Crypto Gambling Regulations in EuropeEuropean countries, even those that are members of the European Union, take different approaches to online and crypto gambling. EU member states are autonomous in the way they organize online gambling, and most of them allow at least some form of internet wagering. The following article contains a detailed overview of crypto and online gambling […]

June 2, 2025

Gambling With Solana vs Tether: Is $SOL a Decent Alternative to Stablecoins?Solana’s decentralised exchanges now move more weekly volume than Ethereum’s mainnet. That raw throughput, combined with sub-cent fees and instant confirmation, tempts crypto-casino players who value speed. At the same time, stablecoins like Tether remain the default chip for gamblers who refuse price swings. But is $SOL a decent alternative, or just another coin that […]

May 29, 2025

TRC-20 Casinos: Top Sites Using TRON’s Fastest NetworkTRC-20 casinos are everywhere these days—but don’t be fooled into thinking they’re just for hardcore Tron fans. While gambling with Tron is possible, it’s not the main usage of the TRC-20 token standard. Below, I’ll show you the best TRC-20 casino sites, which coins you can use, and what makes the TRC-20 standard worth your […]

May 28, 2025

Stake KYC: What to Know about Level 2 Verification for 2025Stake has adopted a stricter KYC process in 2025, making Level 2 verification mandatory from the get-go, at least, if you want to get bonuses and rewards. Near the end of last year, some of our regular readers received an interesting email from Stake Casino about completing Level 2 verification. In the email, Stake explained […]

May 27, 2025

Bitcoin reached new ATH: How does it affect crypto gamblings?Bitcoin blasted through $111,891 on May 22, 2025, locking in a fresh record that still holds steady near the $110,000 mark almost a few weeks later Because most big holders prefer to keep their coins parked instead of cashing out, the supply on exchanges remains tight—and that matters to anyone who gambles with Bitcoin. When […]

May 23, 2025

Best Anonymous Coins for GamblingWant to place a few wagers without broadcasting every transaction to the whole blockchain world? You’re not alone—I’ve spent years testing privacy-focused coins at crypto casinos, and three names consistently rise to the top. Below I’ll break down my go-to choices, share the criteria I used and a handful of practical tips to have a […]

May 23, 2025

Crash Games Like Stake Crash: Best Stake Alternatives!If you know crash gambling, then you know that Crash by Stake Originals is one of the best crash games out there. It’s so good I even listed it as: But is it an ideal crash game? Nope, no game is. Here is a quick list of the best Stake crash alternatives: Before I can […]

May 23, 2025

Best Games Like DraftKings Rocket: Tried & TestedBy now, a couple of crash games have soared to legendary status, practically becoming the icons of their genre. Aviator by Spribe and Rocket by DraftKings Casino are two prime examples. Since not everyone can play due to jurisdictional barriers, we’ll take a look at some games that are just as good, if not better! […]

May 23, 2025

Crash Games with Highest Multipliers: Play These to Win Big!Every crash gambler’s dream is to catch the highest multiplier possible and turn a small bet into a big fortune. Like any dream, this is hard to achieve, but it’s even harder to achieve if you play the wrong games. High maximum payout multipliers & betting limits If you want to win big, you must […]

May 23, 2025

Best VPN-Friendly Crypto Casinos in 2025 | A Complete GuideUsing a VPN when gambling online isn’t just about unblocking sites. It can boost your privacy, protect your data on public Wi-Fi, and even reduce lag. But here’s the kicker—not every crypto casino is okay with it. Some welcome VPNs for legitimate reasons, while others don’t want you to play from a restricted location. In […]

May 23, 2025

BC.Game Crash Betting Strategy Feature ReviewI’m a big fan of Crash by BC Originals, and I’m not the only one—just ask my colleague Jure, who shares the same obsession! We’ve spent hours discussing strategies, analyzing trends, and even experimenting with BC.Game’s custom scripts to find the perfect approach. But now, there’s something new to shake things up: the Betting Strategy […]

May 23, 2025

Top Meme Coin Casinos: Where to Gamble With $DOGE & Co?Meme coins have already generated enough hype—they don’t really need mine. Think Dogecoin and Shiba Inu—or even wackier tokens like PEPE and Bonk. These altcoins may have started as internet jokes, but they now boast massive communities, high liquidity, and plenty of use cases. One such use? Gambling! If you’re looking to combine meme coin […]

May 23, 2025

Tokenization of Betting: The Rise of Utility & Governance Tokens at Crypto CasinosTokenization refers to the process of converting an asset or anything of value into a digital token that can later be traded on a blockchain platform or used as a chip in an online casino. Virtually anything can be tokenized, including the profits casinos make. In this article, we explore the tokenization of betting and […]

May 23, 2025

Crypto Casinos Vs Fiat Online Casinos | 2025 Stats & FactsWondering whether to choose a crypto casino or a traditional online casino? Beyond the type of currency (fiat or crypto) each supports, there are several key differences between the two. Our team has done independent research to bring you the most relevant crypto casino vs fiat casino stats and facts to help you decide. Crypto […]

May 23, 2025

Crypto Gambling Tokens | Best Options in 2025You already know all about gambling online with your favorite cryptocurrency, but what if you could take it a step further and play with digital assets specifically created for online casino platforms? In this article, we’ll take you through the realm of crypto gambling tokens—what they are, why they’re turning heads, and why some players […]

May 23, 2025

How to Gamble Responsibly at Crypto CasinosCrypto casinos offer faster transactions, unique games, and bigger bonuses than traditional online casinos. But all that excitement comes with a potential risk: losing control of your gambling habits. Staying responsible means keeping it fun without letting things go too far. This guide will take you beyond basic safe betting advice; instead, I’ll take you […]

May 23, 2025

Can Bitcoin Casinos Refuse to Pay Out?One of the main concerns for players who gamble online is the fear of being scammed out of their winnings. Fraudulent casinos are everywhere—they will gladly allow you to register and accept your money but will terminate your account or void your winnings the moment you win more than you lost. Because of that, we […]

May 23, 2025

Bitcoin Casino Security: What Makes BTC Casinos Safe?Cryptocurrency and blockchain technology delivered a massive security upgrade to the world of online gambling sites. Bitcoin casinos, in particular, are now protected by distributed ledger technologies (DLT), where data is structured into blocks and where every block contains a record of transactions or a bundle of transactions. These blocks are interconnected in a cryptographic […]

May 23, 2025

How to Buy Bitcoin for Online Gambling?So you’ve heard all the chatter about blockchain gambling and blockchain casinos, and you can’t help but feel the FOMO, right? But wait, there’s a tiny hiccup—you need Bitcoin to get in on the action. If you’re scratching your head wondering how to get started, you’re not alone. And guess what? You’re actually joining a […]

May 23, 2025

What Are Crypto Betting Leaderboards?I’ve spent many hours testing different crypto casinos, and I’ve come to the conclusion of which ones I loved the most—the ones with rankings and leaderboards. Want to know what makes crypto betting leaderboards special and why players keep coming back for more? In this guide, I’ll share real examples and key details that help […]

May 23, 2025

BC.Game Alternatives: Top 6 Casinos Like BC.Game in 2025BC.Game is a one-stop gambling platform that offers casino games, live dealers, and even sports betting. Even so, it has some distinct disadvantages: BC.Game Cons ❌ Restricted in many regions❌ Potential KYC ❌ Min. withdrawal limits could be lower Luckily for you, we’ve done all the hard work and created a list of the best […]

May 22, 2025

Rakebit KYC Policy 2025: Is Verification Required?If you’re after a solid crypto casino, Rakebit deserves a spot on your radar. It’s fast, fun, and refreshingly anonymous—for the most part. But like many crypto platforms, players often ask: Does Rakebit require KYC? And if so, when? In this quick guide, I’ll break down everything you need to know about Rakebit’s verification policy […]

May 22, 2025

Crypto Casino KYC RequirementsCrypto casino KYC requirements are a hot topic now, especially with the latest update regarding Curaçao-issued licenses. If you’ve ever played at a licensed online casino before (crypto or not) you’ll probably have come across the term. For some, the very idea of KYC goes against the core values of crypto—privacy and decentralization. Since it’s […]

May 22, 2025

The Best Gambling VPN: We Give You 5 Options!Are you an avid gambler? A crypto aficionado? What about a fan of not having your data stolen? If you’ve spent any time in crypto/casino communities, you probably know about VPNs. Maybe you’ve heard that using a VPN can help you access sites that aren’t licensed in your country. This can be handy for casinos, […]

May 21, 2025

Crypto Casino Withdrawal Fees: Should You Be Afraid?After depositing and enjoying various crypto casino games, the ultimate aim is to cash out your winnings. However, one crucial factor can greatly affect your payouts: crypto casino withdrawal fees. They can eat into your profits and reduce the amount you take home. That’s why it’s vital to understand withdrawal fees and how to minimize […]

May 20, 2025

The Ultimate Guide to Bitcoin Free Spins – And Where to Find ThemLooking for Bitcoin Free Spins? Browse our list of the best Bitcoin casinos with Free Spin bonuses.

May 19, 2025

Ethereum’s Pectra Upgrade: Is It a Win for Crypto Gamblers?Ethereum’s Pectra upgrade is here—and it’s more than just a tech update. For those gambling with Ethereum, it could mean smoother transactions, lower fees, and faster gameplay, especially on dApps and crypto casinos. While Ethereum isn’t always the first choice for low-cost betting, the upgrade brings new hope for more stable and efficient usage. If […]

May 15, 2025

Stablecoin Casinos: The Full Guide to Gambling with Tether, USDC, and MoreCrypto gambling is thrilling—until the coin you just bet rockets 30% up or 40% down while the roulette wheel is still spinning. Stablecoins solve that headache, as they’re made to tackle crypto volatility. Pegged to assets like the U.S. dollar or even gold, they trade at (or very near) a fixed price, so your stake […]

May 15, 2025

Understanding Maximum Payouts in Crypto Casino Games | Complete GuideWe all want to make a massive profit while playing crypto casino games, but that’s not always possible. And I’m not just talking about the win probability of casino games, but their maximum payouts, too. Many people forget it, but most casino games come with max payouts, just like the sites themselves have an overall […]

May 13, 2025

Trenball Crash by BC Originals: How-to-Play & Strategy GuideIf you’ve read my Crash by BC Originals game review, you’ve seen that I’ve kept the Trenball crash mode a little secret. I did not talk about it. But that all ends today! If you haven’t tried BC.Game casino’s original crash game, yet, trust me, you have to do it now! It’s the best, period. […]

May 13, 2025

Crash Gambling in Numbers: 10 Astonishing StatisticsCrash gambling has been the talk of the town in the iGaming industry for the last few years. Since rising from Bitcointalk forums as a simple community Bitcoin game, this gambling phenomenon shows no signs of stopping. Behind the rising multipliers, the amazing wins, and the heartbreaking moments when the game goes bust out of […]

May 13, 2025

The Best High Flyer AlternativesWhen I first tested High Flyer by Pragmatic Play, I couldn’t ignore how much it felt like Aviator. But it seemed the studio plays things a little too safe. I like more customization, and the lack of provable fairness is a letdown. I’ve lined up the best High Flyer alternatives if you’re after something more […]

May 13, 2025

‘Infinity Play’ Crash Games: What are They & Best GamesFor the past 10 years, crash games have mostly remained the same. Design aside, they all feature the same game mechanics, and I usually say that once you master one, you know how to play them all. Well, that changed with the introduction of Quantum X by Onlyplay. Let’s just say the crash gaming mechanics […]

May 12, 2025

Games Like Aviator: Discover the Best Alternatives!In my detailed review of Aviator by Spribe, I boldly stated that this game is almost like a cult classic of the crash genre – and rightfully so! That being said, I’ll use this article as a way to revisit and explore some of the best casino games like Aviator. By the end of this […]

May 12, 2025

Crash Gambling Hacks, Cheats & Predictors - Do They Work?One thing is certain: winning in crash games is not always easy. As you can imagine, that’s a common problem for many crash gamblers. To ease the frustration, there’s an entire industry dedicated to crash gambling hacks and predictors. These hacks promise guaranteed results, but do they deliver on that promise? I’ve tried them, and […]

May 12, 2025

Crash Game Algorithm Patterns – Can You Predict the Results?Have you ever wondered how a crash game really works? What’s happening behind the scenes? How do you catch those 100X multipliers? Yeah, well, you’re not alone. We’ve dedicated much of our time to this matter and are happy to share our knowledge. So is there an algorithm behind crash games? Yes, all crash games […]

May 12, 2025

History of Crash Gambling: From MoneyPot, BustaBit to NFTs!Back when Nyan Cat was famous, and nobody believed in Bitcoin to the point where spending 10 Bitcoins for a pizza was fun, something magical happened. Can you guess what? We’re here today to tell you how it went down and how it got to the point where we have already reviewed 50+ crash games […]

May 12, 2025

Best Rocket Crash Gambling Games of 2025It’s funny how we all associate rockets with crashing, even though we don’t hear about rockets crashing all that often. But you do hear about rockets crashing more and more in online casinos. And if you’re wondering what’s up with that, I’ve got an explanation! Let’s explore rocket crash games and see if they’re actually […]

May 12, 2025

Understanding Provable Fairness: Seeds, Hashes, HMAC and mathMAXWhen it comes to gambling, trust is everything. Without a sense of fairness, the excitement just isn’t the same. In our previous brush with this topic, we’ve touched on crash gambling algorithms and gave a quick overview of provably fair RNG algorithms. But by popular demand, we’re here to dive deep into how provably fair […]

May 12, 2025

Best Roobet Crash Strategies: Are Any Strategies Profitable?Playing crash games is easy, would you agree? In all fairness, it’s not exactly rocket science. However, not a lot of players out there do it successfully. If you’re one of those players struggling in Roobet’s crash game, we found and tested six strategies that are bound to transform your game. If you’re not playing […]

May 12, 2025

The 5 Best Original Crash GamesAs an avid crash gambler, I’ve spent countless hours testing (and playing for fun!) crash casino games. I’m pretty sure most casual crash players will point out Aviator by Spribe, if I asked them about the first game they have in mind. But I’ve played more than enough to know that original crash games deliver […]

May 12, 2025

Best Cash or Crash Strategies: Win More by Doing This!So you’re playing Cash or Crash by Evolution Gaming, and you can’t break a profit. We’ve been there, trust us. However, we’ve gone past that point as well, and we’re here to help you out. By the end of this article, we’ll reveal our best Cash or Crash strategies that allow us to stay in […]

May 12, 2025

Highest Return-To-Player Crash Games (99% RTP & More)Playing high RTP crash games will significantly increase your odds of winning. This guide will reveal the most rewarding crash games out there!

May 12, 2025

Most Transparent & Fair Crash Games in 2025 - Played & RankedNothing in this life is guaranteed, however, if you’re into crash games, fairness can be! Today, we’re taking a closer look at the best provably fair crash games! Playing potentially rigged crash games is no fun, so stay with us if you don’t want to get cheated ever again. Before we reveal the best provably […]

May 12, 2025

We Tried Steve Will Do It's Crash Strategies (Full Report)You love him, or you hate him, there’s no in-between. However, there is no denying the fact that Steve Will Do It’s rise to fame was astronomical! He managed to become one of YouTube’s biggest stars (now banned) through insane challenges like drinking an entire bottle of Jack Daniels in a matter of minutes and […]

May 12, 2025

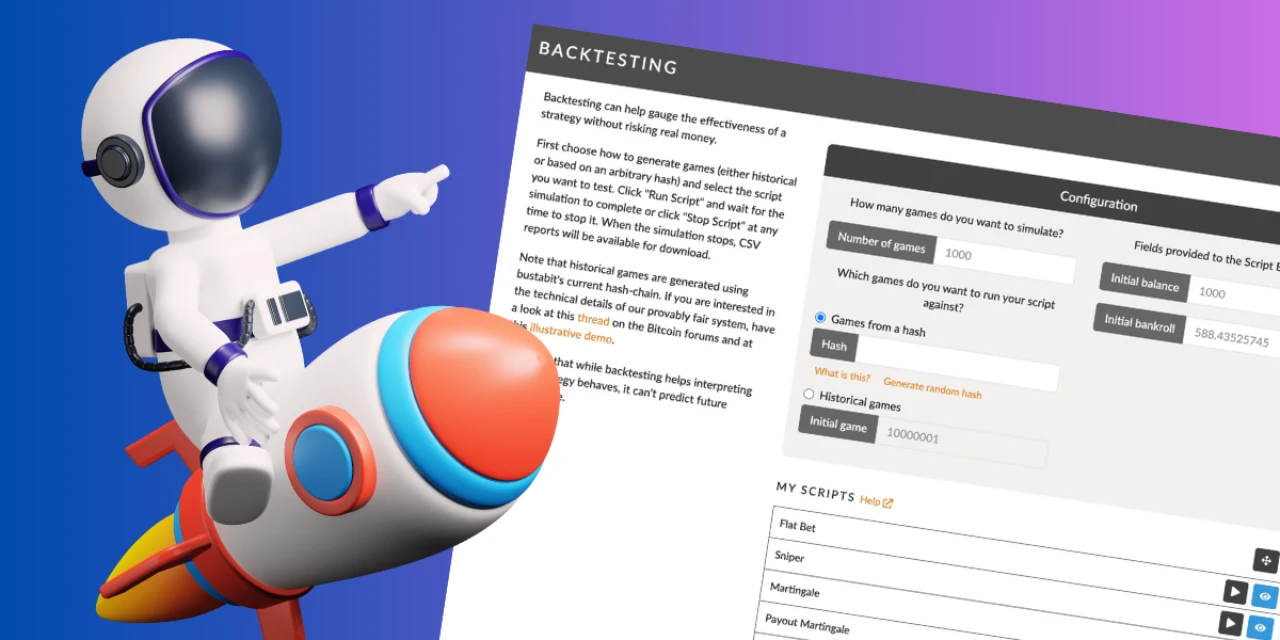

How to REALLY Test Crash Gambling Strategies: Full GuideIf you know Crash Gambler, then you know that one of our most commonly discussed topics is crash gambling strategies. Today, I’ll reveal all the tools and techniques that I use to backtest strategies and test strategies in real time on a live crash game. Let’s start with the latter. 🔑 Key Takeaways: I get […]

May 12, 2025

Crash Gambling Scripts: Live Tests & ResultsMost of us crash gamblers eventually come up with ideas for profitable strategies for our crash gambling adventures. But it’s hard to put those strategies to the test with basic game automation settings that you see in some crash games. But what if I’d told you there is a super-efficient way to do this, and […]

May 9, 2025

Crash Gambling Strategies: Do They Really Work?The fact that crash games are based on luck makes them perfect testing grounds for different betting strategies—and testing them is what I did. From the Martingale system to Fibonacci and Kelly Criterion, I’ve tried them all to see if they actually work or if they’re just smokescreens to keep you betting. Stay tuned to […]

May 9, 2025

Free Crash Gambling Games: Play Without Sign-UpStarting out your crash gambling adventures can be intimidating. I’ve been there, and let me tell you, we lost some serious money while trying to learn the ins and outs of the games. Only here to have some fun? Here is a selection of our favorite crash games that you can play directly on Crash […]

May 8, 2025

How to Play Crash Games | 5 Minute GuideCrash has become the darling of the online casino world. It’s fast-paced, highly rewarding, and easy to play. So easy, in fact, that I’ll tell you everything you need to know about how to play Crash in just five minutes. Stick around to discover: Let’s start with the basics: How to Play Crash: The Basics […]

May 8, 2025

Paroli Betting System: Does it Work?Italy has given the world a lot—including one of the most popular betting strategies that we know in the 21st century. Believe it or not, the Paroli betting system has been around since the 16th century! In this article, I’ll show you how it works, which are the best ways to use it, and compare […]

May 8, 2025

How to Manage Your Casino Bankroll Like a ProManaging your casino bankroll is the single most important skill you should develop as a gambler. You might already have a favorite betting strategy, but without solid bankroll management when betting with Bitcoin and other cryptos, you’ll deplete your funds faster than you can say “all in.” In this guide, I’ll take you through the […]

May 8, 2025

Fibonacci Sequence in Gambling: A Mathematical Guide to Better Betting?The Fibonacci sequence is everywhere around us. You can see the numbers in all aspects of life—like nature, art, music, and the list goes on. It’s closely related to the golden ratio (approximately 1.618). But could the Fibonacci numbers be the “golden standard” for crypto gambling, as well? Ever wondered why some number patterns keep […]

May 8, 2025

Labouchere Betting System: How Good Is It?Testing betting strategies is always something I enjoy. And this time the Labouchere betting system is on my radar. It’s certainly not the easiest to execute, but what if I told you that it’s way better than Martingale? Let me show you how it works, and why it might be worth your time. Created by […]

May 8, 2025

Does The Martingale Betting Strategy Work?The Martingale strategy is one of the simplest and most popular betting systems out there. The idea? Double your bet after every loss so that when you eventually win, you recover everything you’ve lost—plus a little extra. Sounds foolproof, right? Not so fast. In this guide, I’ll show you exactly how the Martingale works, test […]

May 8, 2025

Oscar's Grind Strategy: Is The Grind Worth Your Time?Let’s be honest—not everyone has the temperament for a slow and steady betting strategy. Especially one having the word “Grind” in it. If you’re looking for the thrill of big wins and don’t mind the roller coaster of high-risk gambling—Oscar’s Grind probably isn’t your style. But for the methodical players, this betting strategy might be […]

May 8, 2025

Anti-Martingale Strategy in Crypto BettingAs a very curious player, seeing an “Anti” strategy always makes me pause and wonder—is the original so bad that someone had to create its opposite? That’s what first drew me to the Anti-Martingale strategy. In this article, I’ll show you when (and how) to use it, and whether it’s actually worth your time. The […]

May 8, 2025

The 1-3-2-6 Betting Strategy: Smart Progression or Fancy Gamble?If your ideal betting session involves a mix of controlled risk and potential big wins, the 1-3-2-6 system might be your perfect match. And if you’re wondering whether this sequence of mysterious numbers could be your ticket to more exciting gaming sessions, you’re about to find out. The 1-3-2-6 betting system emerged as a positive […]

May 8, 2025

We’ve Cashed Out At 1.01X in 1000 Rounds Of Crash. Here's What Happened!If you pick any crash game with an RTP of 99%, your chances of winning at a 1,01X multiplier are approximately 98.02%. Sounds pretty good, right? So could you do it in crash gambling? Well, in theory, with a 98.02% chance of winning at the 1,01X cashout multiplier, you indeed can, or so it seems. We […]

May 8, 2025

Casinos Blockchain's Fairness Score: Explanation & ExamplesIn the world of online gaming, fairness is everything. But how can you trust what you can’t see? We’ve developed a provably fair score scale—the first of its kind—to help you evaluate these claims confidently. What Does Our Scale Measure? We’ve redefined what “provably fair” truly means for crash games. Each game we review undergoes […]

May 8, 2025

Dynamic House Edge in Crash Gambling: Does it Exist?The topic of dynamic house edge has been the subject of some heated debates on Reddit, and naturally, I wanted to intervene with some clarity and reason. It’s become quite rare to see crash games convey their house edge like this: ‘3-4%’, but then again, it’s not unseen. So, if you’ve ever wondered what a […]

May 5, 2025

Crypto and Chance: Understanding the Habits of Today's GamblersThe fusion of cryptocurrency and gambling marks a notable development in the digital financial world. This combination has revolutionized transaction methods in the gambling industry and significantly influenced the habits of gamblers. As cryptocurrencies, particularly Bitcoin, gain traction in online gambling, understanding how they are reshaping gambling practices becomes essential. This article, informed by a […]

May 5, 2025

Bitcoin Casino Cashout Guide: How to Cash Out in 4 StepsCrypto gambling is all about fun, but it’s no secret that most of us players want to make a quick buck in the process. Cue the exciting and rewarding process of cashing out! However, as exciting as it may be, there are several challenges you’ll face along the way. These include casino fees, gas fees, […]

May 5, 2025

How Is Bitcoin Made?Bitcoin’s trading value is more than $11 billion, at least at the time of writing. But despite BTC’s renown, many people don’t know how it’s made. To most people out there, the world of crypto is shrouded in mystery. Some Bitcoin casino players bet using BTC without having the foggiest idea of where their crypto […]

May 5, 2025

From Decentralized to Crypto: How Blockchain Changed GamblingBlockchain technology has redefined many industries, and the gambling sector is no exception. With its promise of transparency, fairness, and decentralization, blockchain initially seemed like the perfect fit for online casinos. The introduction of decentralized casinos, built on decentralized apps (Dapps), sparked excitement with their potential to revolutionize gambling. However, not all decentralized casinos achieved […]

May 5, 2025

Telegram Casinos: Your Guide to Telegram GamblingYou probably know Telegram as a messaging app with strong privacy, a love for bots, and a massive range of chat groups. But there’s more to it than that—Telegram has also become a surprising hub for gambling. Recently, Telegram casinos have popped up, letting you place bets, play games, and try your luck all through […]

May 5, 2025

Which Cryptos Have the Cheapest Fees for Gambling?No one wants to lose money before they even start playing, but that’s exactly what can happen when you gamble with high-fee cryptocurrencies. Luckily, some cryptos are far cheaper to use than others, helping you keep more of your bankroll for actual play. Key Takeaways 🔑 Cryptos With the Lowest Fees for Gambling Now, let’s […]

April 23, 2025

The Best Crypto Casino Airdrops in 2025Crypto casinos are revolutionizing online gaming, and airdrops are becoming a powerful tool for both casinos and you as a player. In this article, I’ll explore the concept of crypto casino airdrops, guide you through how to claim them, and take a closer look at some of the top crypto casinos offering exciting airdrop opportunities. […]

April 16, 2025

The Best Provably Fair Bitcoin Casinos and Games (2025)Provably fair casino games are all the talk in 2025. More casinos are jumping on the bandwagon and adding provably fair games, with some even creating their own innovative titles. But beyond all promotional hype, how are you supposed to know which crypto casino really has the best provably fair games? I’ve got you covered! […]

April 16, 2025

Best Low-Limit Bitcoin Casinos for Everyday PlayersMove over, high-roller casinos! It’s time for another type of casino to steal the spotlight: low-limit Bitcoin casinos. For the everyday player, being able to make small and frequent transactions is paramount. Unfortunately, this isn’t always possible with casinos that impose high minimum deposits and withdrawals. Don’t worry; we’ve got you covered. I won’t beat […]

April 14, 2025

Best Crypto Casino No Deposit Bonuses in 2025A quick search on any casino forum will show you just how popular crypto no deposit bonuses are—scarce as they may be. They almost sound too good to be true. Can you really score free crypto at online casinos without placing a deposit first? The answer is yes, and there are several solid no deposit […]

April 11, 2025

GamesWhat’s the first thing that comes to mind when you think about crypto casino games? Provably fair roulette? Bitcoin slots? Edgier blockchain-based games like crash or plinko? There’s no casino game that you can’t play with cryptocurrencies these days. Browse our list below to find out where you can play them!

April 10, 2025

Online and Crypto Gambling Regulations in LatAm – 2025 OverviewCountries from Latin America range from those that approve and regulate crypto gambling and gambling in general to those that restrict them altogether. The following article contains a detailed overview of online gambling legislation across Latin America, including how specific markets are regulated, the pending laws, and the future of the industry. Disclaimer: Our team […]

April 9, 2025

Online & Crypto Gambling Regulations in AustraliaWondering if online and crypto gambling is legal in Australia? You’re not the first person to have these concerns before signing up at a Bitcoin casino in Australia. I’ll take you through what you need to know. Disclaimer: This information was last fact-checked by our team on April 9, 2025. Please note that legal frameworks […]

April 4, 2025

Fast Sign-Up Bitcoin Casinos: We Signed Up in 29 Seconds!User experience plays a major role in consumer adoption and retention. Whenever we use a website, we expect it to be responsive and fast, easy to navigate, and feature a blend of inviting colors pleasing to the eye. When it comes to websites we plan to register on, however, we also want a smooth and, […]

April 4, 2025

Decentralized Casinos: The Best Gambling Dapps in 2024Gambling with crypto is one thing, but did you know that casino games are now offered through decentralized applications, or Dapps, for short? Since decentralized casinos rely exclusively on the blockchain, they are the epitome of blockchain gambling—in its truest form. In this guide, I’m going to take you through: Before I get into the […]

April 4, 2025

Online & Crypto Gambling Regulations in Africa – 2025 OverviewCountries in Africa take a varied stance towards gambling and crypto regulation, ranging from those that regulate both or at least one of them to those that ban them altogether. This article contains a complete overview of online and crypto gambling regulations across Africa, including information about the markets, the incumbent and pending laws, and […]

April 4, 2025

Worldwide Online and Crypto Gambling Status — 2025 OverviewThe following articles contain detailed overviews of online and crypto gambling legislation across the globe, including how specific markets are regulated, the pending laws, and the future of the industry. Don’t hesitate to browse these articles to find out everything you need to know about gambling regulations.

April 4, 2025

Crypto vs Blockchain vs Bitcoin Casinos: Do They Mean the Same Thing?While the terms “crypto casino”, “blockchain casino”, and “bitcoin casino” are often used interchangeably, they can have different meanings based on the specific features and technologies the casinos in question use on a day-to-day basis. But what most people want to know is, are they all the same thing? It’s time to cut the confusion. […]

April 4, 2025

Crypto and Chance: Understanding the Habits of Today’s Gamblers | InfographicWondering about gamblers’ habits? We just wrapped up a survey digging into the nitty-gritty – from how money flows in the gambling scene to whether crypto market fluctuations affect gaming habits. Plus, if you’re into the details, check out the in-depth analysis of our poll results. But now feast your eyes on the infographic breaking […]

April 4, 2025

What Is GambleFi?The gambling industry is no stranger to innovation, and the latest frontier for this rapidly evolving field is GambleFi. But what exactly does this buzzword mean, and why should you care about it? The Basics: What Is GambleFi? At its core, GambleFi refers to the integration of DeFi tools, platforms, and principles into the world […]

April 4, 2025

Crypto Casinos 101: A Beginner’s Guide to Key ConceptsStarting your journey into the world of crypto casinos can feel overwhelming, but understanding a few key concepts can make all the difference. Whether you’re new to cryptocurrency or just curious about how these casinos work, this guide will break down some of the basic concepts you’ll come across. Crypto Casino Concepts: A — Z […]

April 4, 2025

No-Limit Casinos: Our Top Five Picks of 2025Disappointed by casino limits? Not at these gambling sites—today we’re talking about the best no-limit casinos of 2024! We picked out the five best no-limit casinos of 2025. They’re also crypto-friendly and offer some juicy bonuses. So without further ado, let’s get started! If you’re in a rush to get playing, we won’t keep you […]

April 4, 2025

Betcoin Casino ReviewLoading Betcoin for the first time can be quite a surprise: you will be whisked away to what looks and feels like a Vegas live show. Behind all that glitz and glamor, you’ll find a site with all the games you might want to play, a live casino to get more personal, and an extensive […]

April 4, 2025

How to Make a Bitcoin Deposit in Crypto Casinos in 2025Nearly half of all Bitcoin transactions are tied to gambling—so it’s no surprise that many people buy BTC just to play casino games. If that’s you, you’re in the right place. In this quick guide, I’ll show you how to deposit Bitcoin at online casinos without a hitch. You’ll learn how to do it securely, […]

April 4, 2025

Best Bitcoin VIP Casino Programs (2025)Crypto VIP casino programs reward loyal players who continue depositing and playing on the platform. Think of them as a casino’s way of saying, “You are appreciated, and here are some extra perks to go with that appreciation.” The VIP programs at Bitcoin casinos deliver a plethora of bonuses, from deposit match deals to rakeback […]

April 4, 2025

Blockchain Casino Awards - The Best Crypto Casinos in 2021Discover the best casinos offering cryptocurrency payments and integrating blockchain technology into your player experience.

April 4, 2025

The Environmental Impact of Bitcoin | Bitcoin InfographicIs Bitcoin a sustainable coin? What are the power requirements of BTC? Let's find out!

April 4, 2025

What Happened to Unikrn? | eSports Platform ClosedUnikrn, an eSports betting brand owned by Entain, has officially announced its shutdown, with all betting activities ending on October 20. The standalone Unikrn app in Brazil, Canada, and Chile will be integrated into Entain’s other online sportsbooks. As one of the first ETH casino and gambling projects (their native token was on the Ethereum […]

April 4, 2025

Bitstarz App | Mobile iOS and Android CasinoBitStarz is one of the most renowned online casinos that accept Bitcoin, and that’s no bold statement. While reviewing BitStarz, I discovered it’s an incredibly well-rounded website. But does it deliver the same user experience on your phone as on your computer? I thought it was worth digging a bit deeper into the topic. In […]

April 4, 2025

Coinbase Casinos | Can Coinbase be Used for Gambling?Right off the bat, I’ll tell you that Coinbase cannot be used for gambling. The Coinbase gambling policy prohibits crypto casino transactions because most crypto casinos are not sanctioned by a governmental or regulatory authority. The exact policy is against: This is why we at Casinos Blockchain recommend switching to another crypto gambling wallet. In […]

April 3, 2025

How to Get a Profit from Bitcoin GamblingWe might be stating the obvious here, but we’re going to say it regardless—gambling is a risky business. So, why do we still do it, even with the odds stacked against us? Well, it’s rather simple; gambling is exciting! Besides, who doesn’t like beating the odds? In fact, what if we told you that you […]

April 3, 2025

Online & Crypto Gambling Regulations in AsiaAsian countries take different views regarding crypto gambling regulation and gambling regulation. This article contains a detailed overview of crypto gambling legislation across Asia, including: So, without further ado, let’s check out the data! Disclaimer: Our team last fact-checked this article on October 14, 2024. Please note that legal frameworks related to gambling and digital […]

April 3, 2025

Best Crypto Casino Easter Bonuses and Promotions (2024) 🐰Easter, a time of renewal and celebration, brings not just the joy of spring but also the thrill of exclusive rewards in the digital realm, and crypto casinos have certainly jumped on the bandwagon. As the festive spirit fills the air, these platforms unveil their Easter bonuses. They’re not just ordinary promotions; they are carefully […]

April 3, 2025

Risk to Reward: Understanding Volatility in Crypto Casino GamesWhen you start playing different crypto casino games, you’ll quickly notice they are not all created equal. Aside from featuring different Return-to-Player percentages (RTPs) and mechanics, they also have another vital aspect contributing to the games’ payouts — volatility. Volatility refers to how often a game pays on average, and mastering it can significantly enhance […]

April 3, 2025

Rollbit Alternatives: 4 Sites Like Rollbit (And Better) in 2025Rollbit is an excellent crypto casino—and you probably already know that if you’ve landed on this page. Unfortunately, Rollbit isn’t for everyone. Why? Rollbit Cons ❌ It has KYC and a long list of restricted countries❌ There’s no welcome bonus❌ It only accepts eight cryptocurrencies In this article, I’ll introduce you to the top sites […]

April 3, 2025

The Best Crypto Trading Games in 2025A crypto trading game is an online casino game where you bet on whether the price of a cryptocurrency will rise or fall. It’s notoriously simple and fun, yet still pretty rare. There are two types of crypto trading games: Now that you’re up to speed with the basics of this exciting new genre of […]

April 3, 2025

How to Tell if a Crypto Casino Is LegitIs it a legit crypto casino, or is it a scam? I’m going to tell you how to find out! Before you place your first bet, let’s talk about how to tell if the crypto casino you’re considering playing at has a solid reputation. I’m here to share the secrets of spotting a reputable casino […]

April 3, 2025

Gambling Advice from AI: Can We Trust LLMs?In 2024, large language models (LLMs) are changing the way we handle information, especially on tricky topics. These AI systems can churn out text that’s almost indistinguishable from what a human might write based on heaps of data they’ve been fed. Now, let’s zoom in on a topic that’s both sensitive and significant: online gambling. […]

April 3, 2025

Best Plinko Games in 2025: Crypto-Friendly and High RTPsDid you know that Plinko’s origins can be traced back to the 1920s, when the traditional Japanese game Pachinko was introduced? Today, Plinko is well-known as a provably fair arcade game with a simple concept. In this article, I’ll take you through the five best Plinko games and point you in the direction of the […]

April 3, 2025

What Is the Best Plinko Strategy? I Tested and Found OutThe allure of Plinko lies in its simplicity and luck-based gameplay. However, like any casino game, Plinko fans are always on the lookout for strategies to tilt the odds in their favor. I tested all the top “winning” Plinko strategies to find out which ones hold up in real-world play, and which are just myths. […]

April 3, 2025

A Guide to Plinko Odds: What Are the Odds of Winning Plinko?The odds in Plinko depend on the risk level, number of rows, and RTP of your chosen game variation. The best Plinko casinos have various options to choose from, but how do you work out the odds for each one of them? That’s where this guide comes in! Stick around to learn how Plinko odds […]

April 3, 2025

The History of Plinko: In Just 6 MinutesPlinko is a game that has captured the imagination of millions since its debut on “The Price Is Right” TV show. Its simple yet captivating mechanics have guaranteed its long term popularity, evolving into various forms, including its latest incarnation as the provably fair Plinko crypto casino game we know and love. In this article, […]

April 3, 2025

Lucky Bounce Back | Turn Bad Luck into USDT Rewards!We all know that luck can be unpredictable, but at Casinos Blockchain, we believe in second chances! Our Lucky Bounce Back campaign is a special way to reward loyalty and give back to our most dedicated players who experienced a bit of bad luck during the previous month. Time Left Results 🏆 The Lucky Bounce […]

April 3, 2025

The Best Bitcoin Casinos with Instant Withdrawals in 2025Waiting hours or even days for your casino winnings is a thing of the past. Today, there are dozens of instant withdrawal Bitcoin casinos that offer fast and seamless payments to your wallet. So, what are the best Bitcoin casinos with instant withdrawals? I won’t keep you waiting. After days of testing, I shortlisted the […]

April 2, 2025

Crypto Loans: Can They Be Used for Gambling?Have you ever come across crypto loans? It might sound strange at first—why borrow crypto when you could just sell? But for many, crypto loans offer a smart way to access extra funds without sacrificing potential gains. Today, I’ll explore what crypto loans are, the different types available, and whether they might work for gamblers […]

April 2, 2025

DAOs in Crypto Casinos: Can You Really Influence Casino Decisions?Crypto casinos are always evolving, and one buzzworthy innovation is the introduction of DAOs—Decentralized Autonomous Organizations. You might have heard whispers of this: a system that promises to put decision-making power directly into your hands as a player. But let’s pause for a second. Does this really mean you can shape the way a casino […]

April 2, 2025

All or Nothing: Why the All-In Strategy Falls ShortThe All-In gambling strategy is as extreme as it sounds: betting your entire bankroll on a single outcome. It’s the gambling equivalent of “go big or go home.” But is it a smart way to play? Spoiler: not really. In this guide, I’ll explain how the All-In strategy works, why it’s risky, and the rare […]

April 2, 2025

How to Read Pay Tables in Crypto Casino GamesDiving into a casino game without checking its pay table or game info is like playing a sport without knowing the rules—you’re putting yourself at an unnecessary disadvantage. A pay table or info section is your roadmap to understanding any game, be it slots, poker, or Crash. In this guide, I’ll show you how to […]

April 2, 2025

How to Choose a Network for Crypto Casino TransactionsIf you’ve ever had a transaction delayed or lost money to sky-high fees, you know how important it is to choose the right network for your crypto casino deposits and withdrawals. Between the various coins, networks, and casino compatibility, it can sometimes feel overwhelming. Luckily, it doesn’t have to be complicated. In this guide, I’ll […]

April 2, 2025

The Fastest Cryptocurrencies for Gambling TransactionsCryptocurrency gambling thrives on speed—fast deposits and withdrawals mean you can start playing (or cash out your winnings) without delay. If you’ve ever had to wait for a sluggish Bitcoin transaction to confirm, you know how frustrating slow speeds can be. The good news? Some cryptocurrencies are faster than others, and we’ll take you through […]

April 2, 2025

Stake Alternative: The Top Stake Casino Alternatives in 2025Stake.com has grown into one of the largest online casinos in the world. The gambling site offers over 3,500 casino games, including 19 in-house originals, plus sports betting. Even so, a growing number of gamblers are looking for a Stake alternative. Why? Stake Cons ❌ There is no welcome bonus❌ Stringent Stake KYC policies The […]

March 26, 2025

Top 5 Crypto Casino Sites Like Luckybird.io to Consider in 2025Luckybird.io is a very nice sweepstakes casino powered by SoftSwiss. It was launched in 2022, and it has already built a solid reputation over the years. On top of that, it also has provably fair games, which my team and I like a lot. Yet, I can’t say it’s perfect. Luckybird.io Cons ❌ Monthly withdrawal limit […]

March 24, 2025

CryptocurrenciesFull list of cryptocurrencies available to play casino games with. From the most popular to the most exotic altcoins, there’s something for everyone!

March 20, 2025

Casinos Like BetFury: The 5 Best AlternativesIf you’re seeking BetFury alternatives, you may have already tasted BetFury, and let me tell you—it’s an amazing crypto casino. But as much as I like it, there are some negative aspects that prevent it from ranking in our top 10 crypto casinos, or at least for now. BetFury Cons ❌ It is restricted in […]

March 19, 2025

How Crypto Casinos Use Yield Farming & Staking to Reward PlayersWhen I first heard about yield farming and crypto staking in crypto casinos, I thought it sounded too good to be true—gambling meets decentralized finance (DeFi). But I realized there’s real potential here. In this guide, I’ll walk you through how yield farming and staking work within the context of crypto casinos, what risks and […]

March 17, 2025

Transaction Limits at Crypto Casinos | 2025 GuideIt doesn’t matter you’re chasing big casino bonuses or not, the real game starts when it’s time to cash out. And here’s the kicker—deposits, withdrawals, and those sneaky casino limits are the last thing on your mind when signing up, but the first thing to trip you up when it matters most. Casual player or […]

March 13, 2025

D’Alembert Strategy: A Balanced Approach to Casino Gambling?If you’ve ever felt torn between the kamikaze style of Martingale and the slow-burn approach of Oscar’s Grind, let me introduce you to the D’Alembert system. In this article, I’ll explain the D’Alembert system in practical, real-world terms. I’ll also share my personal test session for that oh-so-important “hands-on” perspective. Let’s see if this classic […]

January 22, 2025

Can You Gamble with $TRUMP?If someone had told me a US president would launch a meme coin, I’d have laughed it off. But it’s 2025, and here we are—$TRUMP is live and even overshadows a $100K+ Bitcoin in the “buzz department.” OFFICIAL TRUMP, as the token is called, has skyrocketed to 4th place in trading volume and secured listings […]

December 3, 2024

Player Casino Reviews: Can You Trust Them?As with any powerful industry, iGaming can be a subject of business practices that don’t exactly fall under the “ethical” category. Given the $97.15 billion online gambling market size, you do realize that casinos have more than enough reasons to present themselves in the best possible light. When I first started testing casinos professionally, I […]

April 4, 2025

Bitcoin Gambling Strategies: Do They Really Work?Learn how to optimize your game with the best Bitcoin gambling strategies.

April 4, 2025

Casinos Like BitStarz (Top BitStarz Casino Alternatives in 2025)BitStarz is arguably one of the most popular Bitcoin casinos out there – for a good reason, too. If you’re a BitStarz fan, looking for similar casinos to enjoy, you’re in the right place. In this article, I’m unpacking the best casinos like BitStarz. These Bitcoin casinos also boast plenty of cryptos, great bonuses, and […]

April 4, 2025

What Is RNG in Gambling? Randomness at Blockchain Casinos and BeyondAre casino games really random? Can blockchain technology improve their fairness?

April 4, 2025

Understanding House Edge and RTP at Crypto Casinos (2025 Guide)If you’ve ever played at an online casino before, you may have wondered how the house makes a profit. After all, “the house always wins.” But how? There are many myths about how casinos make their money. Some believe games are always rigged to lose. Others think games have paying patterns: they ‘unlock’ only after a […]

May 22, 2025

Anonymous Crypto Casinos – Your Guide to No KYC GamblingSafeguarding our privacy online is an issue that has become increasingly important as technology evolves and more and more of our life takes part on the internet. However, this is simply not possible at traditional online casinos or most crypto casinos. This sensitive information goes way beyond your name and email accounts, often including copies […]

April 4, 2025

The Proof is in the Play: Exploring Provably Fair Gambling with Insights from BGamingProvably fair technology has revolutionized online gambling. The concept removes even the tiniest possibility of a rigged result. With provably fair games, you can verify the authenticity of each game round. This means the casino or game provider can’t manipulate the outcome, because the result is verifiable. Provably fair games are available at a growing number of […]