Cryptocurrency and Blockchain Adoption in Different Sectors

As part of the second CasinosBlockchain scholarship initiative, we asked students worldwide for their input on cryptocurrency and blockchain adoption in different sectors. We were thrilled to receive close to 100 essays. But only one could receive the $1,000 prize. And, after much deliberation, we chose our winner…

The Winner

Congratulations to Adeola Fadeyi from New York, USA! Adeola is a newly enrolled MBA student at Binghamton University School of Management. She impressed us with her data-rich, well-structured essay.

Her winning submission is as follows:

Cryptocurrency and Blockchain Adoption in Different Sectors – Is Cryptocurrency the Future of Financial Systems?

Forget cash, forget credit cards. The future of finance might be a world powered by digital currencies. In fact, a survey found that over 46 million Americans have already used cryptocurrency, and that number is only growing. This surging interest highlights the growing adoption of both blockchain and cryptocurrency across various sectors.

However, cryptocurrencies are only the very beginning.

The technology behind them, blockchain, is poised to revolutionize not just finance, but countless industries across the globe. Is this a passing fad, or a glimpse into the future of how we conduct business?

Cryptocurrency Vs. Blockchain

Imagine a world where secure financial transactions happen without a bank. That’s the promise of cryptocurrency and blockchain, two sides of the same innovative coin.

Cryptocurrency is the actual digital asset, like a virtual coin, that you can use to buy things or trade. But how do we ensure these transactions are secure and can’t be tampered with?

That’s where blockchain comes in. It’s a secure record-keeping system that tracks all cryptocurrency transactions transparently. Think of it as a public ledger everyone can see, making sure everything is above board.

It’s no wonder that over 400 million people worldwide now own crypto as an alternative financial tool. This focus on eliminating trust aligns perfectly with the famous quote by Satoshi Nakamoto, the anonymous creator of Bitcoin:

The root problem with conventional currency is all the trust required to make it work.

Blockchain solves this by creating a system that doesn’t need a central authority. And its impact goes beyond finance, transforming industries like healthcare, supply chain management, and even gambling.

But how exactly does blockchain achieve this trustless environment and empower such widespread transformation? The answer lies in its core functionalities.

Core Functionalities of the Blockchain

The transformative potential of cryptocurrency hinges on the robust foundation provided by blockchain technology. Here’s how blockchain’s core functionalities empower a revolution in financial systems:

A. Decentralization and Security

Traditionally, financial institutions act as gatekeepers, verifying and recording transactions. Blockchain disrupts this model by distributing the ledger across a network of computers. This eliminates a single point of failure and makes the system highly resistant to hacking or manipulation.

Each transaction is cryptographically secured, ensuring its authenticity and preventing alterations. A prime example of this security is the immutability of the blockchain.

The Ethereum blockchain’s DAO (Decentralised Autonomous Organisation) was manipulated by a hacker in 2016. However, due to the decentralized nature and strong cryptography, the attack was reversed, showcasing the resilience of blockchain technology.

Each transaction is cryptographically secured, ensuring its authenticity and preventing alterations.

B. Transparency and Immutability

“Transparency is the best disinfectant,” says Lysaght (2005) in his book Information Technology and Governance. This idea is realized by blockchain technology, which builds confidence in a decentralized system by producing an open, verifiable record of transactions.

Every transaction on a blockchain network is visible to everyone on the network.

This transparency fosters trust and reduces the risk of fraud. Furthermore, a transaction cannot be altered once it is registered on a blockchain. This immutability creates a permanent and verifiable record of all financial activities, enhancing accountability and reducing disputes.

These core functionalities – decentralization, security, transparency, and immutability – form the bedrock upon which blockchain’s transformative potential rests. They pave the way for a future where trust is built into the system itself, not reliant on intermediaries.

But the impact of blockchain goes beyond finance. It also can potentially revolutionize industries like healthcare, supply chain management, and even voting systems.

Let’s see how blockchain is transforming these industries.

Use Cases of Blockchain and Cryptocurrency Across Various Sectors

Cryptocurrency and blockchain are often mentioned in the same breath as finance, but their potential extends far beyond. Here are some exciting use cases with real-world applications:

A. Healthcare Industry

Dr. Lisa Su, CEO of Advanced Medical Technologies, perfectly captures the essence of blockchain’s potential in healthcare:

Blockchain’s ability to provide safe, open, and patient-centered data management has the potential to completely transform the healthcare industry. Better care coordination, more effective clinical trials, and the advancement of personalized medicine could follow from this.

Building on Dr. Lisa Su’s vision, let’s delve deeper into the specific advantages the healthcare sector stands to gain from the combined power of blockchain and cryptocurrency.

1. Secure and Patient-Centric Medical Records

Blockchain creates a secure and tamper-proof platform for storing patients’ medical records. Patients would have complete control over who can access their information, streamlining data sharing between authorized healthcare providers.

This aligns with the growing focus on patient empowerment and data privacy. A 2023 survey by the Pew Research Center revealed that 72% of Americans believe they have very little or no idea of how their information is used. Blockchain can address this concern by putting patients in control of their data.

MedChain is a real-world example of a blockchain platform designed to improve healthcare data management. MedChain allows patients to securely control their medical records and grant access to authorized healthcare providers. While the initial pilot program launched in Dubai in 2017, numerous healthcare institutions worldwide are exploring similar blockchain solutions.

2. Streamlined Insurance Claims and Payments

The current healthcare claims process can be slow and cumbersome, leading to high administrative costs for both healthcare providers and insurers. In the US alone, estimates suggest administrative costs account for 15% to 25% of healthcare spending.

Fortunately, blockchain technology offers a solution. By automating claim processing and adjudication, blockchain can reduce manual tasks and streamline the process, potentially saving the healthcare industry up to $180 billion annually in administrative costs associated with medical claims processing.

3. Medical Research and Innovation

Blockchain can create a secure platform for researchers to share sensitive medical data while maintaining patient privacy. This could accelerate medical research and drug development by enabling secure collaboration between institutions.

A prime example of this potential lies in the field of genomics research. This research paper published on ResearchGate discusses how blockchain technology can be used for sharing and storing genomic data. Blockchain offers a secure and accountable alternative to traditional methods for genomic data management, which is particularly important due to the sensitive nature of this information.

B. Supply Chain and Management Industry

The traditional supply chain, with its complex web of participants and potential for information gaps, can be inefficient and vulnerable. But blockchain technology, along with strategically applied cryptocurrency, offers a transformative solution.

Here’s how:

1. Enhanced Transparency and Traceability

Imagine tracking a product’s journey, from raw materials to your doorstep, in real time. Blockchain allows for this by creating an immutable record of every step in the supply chain. Each participant can access and update this shared ledger, ensuring transparency and accountability. This is particularly valuable for industries like food and pharmaceuticals, where counterfeit products can have devastating consequences.

2. Combating Counterfeiting and Fraud

Counterfeit goods not only cost businesses billions annually (an estimated $1.2 trillion according to the OECD) but also pose safety risks to consumers.

As industry expert Susan T. Fowler aptly states:

Blockchain has the potential to forever change the battle against fakes by providing a secure and transparent way to track and verify the true origin of goods.

When a genuine product is manufactured, it receives a unique identifier that’s linked to its specific details on the blockchain. This could be a physical tag or a digital code embedded within the product packaging.

As the product moves through the supply chain (from manufacturer to distributor to retailer), each participant scans the unique identifier and updates the blockchain ledger with the new location and ownership information. Retailers and consumers can use the unique identifier to access the product’s history on the blockchain.

3. Streamlined Operations and Reduced Costs

Manual processes like document verification and reconciliation plague traditional supply chains, leading to errors and delays. Blockchain automates many of these tasks through smart contracts – self-executing agreements triggered when predefined conditions are met.

A smart contract may, for instance, instantly reimburse a provider when delivery has been confirmed. This reduces administrative burdens, streamlines processes, and minimizes human error.

A real-world example of blockchain in action is the collaboration between Walmart and IBM on the Food Trust platform. To improve transparency and guarantee food safety, this software tracks the flow of food goods via the supply chain using blockchain.

C. Gambling Industry

The world of gambling is also getting a shake-up from blockchain and cryptocurrency. Here’s how these technologies are changing the way we play:

1. Provably Fair Games

Online casinos can leverage blockchain to offer provably fair games. This means the outcome of each game can be demonstrably random and untampered with. The logic behind the game and the random number generation process are recorded on the blockchain, allowing players to verify fairness independently. This builds trust with players who might otherwise be skeptical of the fairness of online platforms.

2. Secure and Transparent Transactions

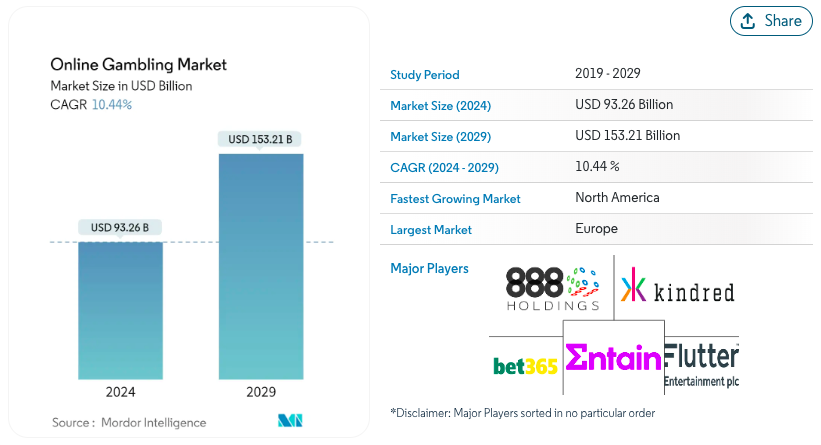

Using credit cards, which are vulnerable to fraud and chargebacks, is no longer necessary thanks to cryptocurrency. Transactions are recorded on the blockchain, ensuring security and transparency for both players and casinos. Global internet gambling revenue is expected to reach an astounding $153.21 billion by 2029, according to an analysis by Mordor Intelligence. As online gambling continues to grow, secure and transparent payment methods like cryptocurrency will become increasingly important.

3. New Gaming Models and Revenue Streams

Blockchain facilitates the development of decentralized gambling platforms (DApps). These platforms operate on a peer-to-peer network, eliminating the need for any third-party intermediaries or central authorities.

This allows for more transparent and secure gameplay, along with potential benefits like faster transactions and lower fees compared to traditional online casinos. Casinos can also explore revenue streams from commissions on NFT sales and In-game item sales.

For example, Decentraland, a metaverse platform built on blockchain, already features provably fair games and explores integrating various gambling experiences.

The Ripple Effect: How Cryptocurrencies and Blockchain Impact Business Operations and Innovation

The influence of cryptocurrencies and blockchain goes far beyond just financial transactions. These technologies are poised to alter how businesses operate and innovate across various sectors fundamentally.

Let’s explore some key impacts:

- Increased Efficiency and Automation

Smart contracts can automate many business processes currently requiring manual intervention. This streamlines operations, reduces errors, and frees up resources for other tasks. A study by McKinsey & Company estimates that blockchain can automate up to 70% of manual paperwork in trade finance processes, potentially saving businesses trillions of dollars annually.

- Enhanced Security and Trust

Data breaches cost $4.45 million on average worldwide, according to IBM’s Cost of a Data Breach Report 2023. Blockchain’s tamper-proof nature fosters trust and transparency in business dealings by offering secure data storage and tracking, minimizing the risk of fraud or manipulation. This is especially helpful in sectors where data security is critical, including banking and healthcare.

- Creation of New Business Models and Revenue Streams

Blockchain opens doors for innovative business models. For example, a startup called “ShareRing” uses blockchain to create a secure platform for individuals to share their data.

- Tokenization of Assets

Companies could tokenize assets, allowing for fractional ownership and easier investment opportunities. Businesses can leverage Initial Coin Offerings (ICOs) to raise capital directly from the public. These possibilities can lead to entirely new revenue streams and disruptive business models.

Cryptocurrency and the Future of Finance: Looking Ahead

The rise of cryptocurrencies and blockchain technology has rocked the world of finance. Looking at the potential benefits, there’s a compelling case for crypto’s transformative role:

- A More Inclusive and Decentralized Financial System

One of the most compelling promises of cryptocurrency is financial inclusion. Over 1.7 billion adults globally remain unbanked, according to the World Bank, lacking access to traditional financial services. Cryptocurrency offers an alternative financial system, accessible to anyone with an internet connection.

- Faster and Cheaper Transactions

Cryptocurrency transactions can bypass intermediaries like banks, leading to faster settlement times and potentially lower fees. A report by the World Bank found that the average global cost of sending remittances is around 6.2%. Blockchain technology can drastically lower these costs, resulting in quicker and more inexpensive international money transactions.

- Decentralized Control

Cryptocurrencies function on a decentralized network, in contrast to conventional currencies that central banks manage. This reduces reliance on a single authority and potentially offers greater control to users over their finances.

As Andreas Antonopoulos, a prominent blockchain advocate, puts it:

The blockchain is a technology that allows us to move from trust-based systems to cryptographically verifiable systems.

This shift towards a decentralized model could empower individuals and reshape how we interact with financial institutions.

However, despite the potential benefits, significant challenges loom:

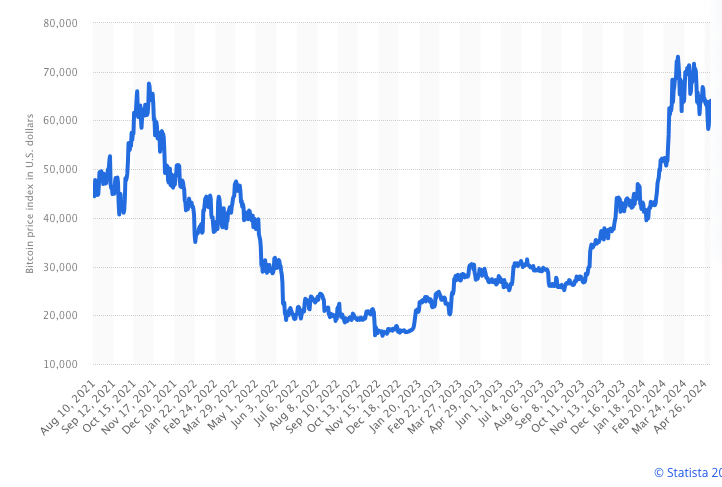

❌ Volatility

Several cryptocurrencies have extremely volatile values. This volatility makes them a risky investment and potentially impractical for everyday transactions.

❌ Scalability

Current blockchain technology, particularly those reliant on proof-of-work mechanisms, can struggle to handle large transaction volumes. This hinders widespread adoption for mainstream financial applications. Visa, for example, processes tens of thousands of transactions per second, while Bitcoin’s network can only handle around seven transactions per second. To fully realize the promise of blockchain, this scalability issue must be resolved.

Will Cryptocurrencies Replace Traditional Financial Systems Entirely?

Alistair Milne, Chairman of the Global Financial Markets Sandbox at the Dubai International Financial Centre (DIFC) captures this trend perfectly:

The future is not about cryptocurrencies replacing traditional currencies; it’s about them coexisting and interoperating to better serve consumers and businesses alike.

The future of finance likely won’t be a complete overhaul. A more realistic scenario involves a coexistence of traditional and digital currencies, each serving different purposes.

Cross-border transfers take three to five days on average to process and cost around ten percent of the transfer amount, according to research by the Bank of International Settlements (BIS).

Blockchain-based cryptocurrencies, on the other hand, offer near-instantaneous settlements and potentially lower fees, making them attractive for international transactions.

Similarly, traditional financial institutions might even begin offering cryptocurrency-related services to cater to evolving customer demands. We’re already seeing glimpses of this trend, with major banks like JPMorgan Chase and Goldman Sachs exploring blockchain technology and (the former) even considering launching their own digital currency.

Final Thoughts

The financial landscape might become more inclusive and safe, transparent transactions could be made possible by blockchain and cryptocurrencies, which have the potential to transform several sectors completely.

However, there are challenges such as volatility and regulatory uncertainty. As the technology matures and regulations evolve, we can expect to see a collaborative landscape where blockchain and cryptocurrency work alongside existing systems to create a more efficient, secure, and accessible financial ecosystem for all.

One thing is certain: the financial landscape is undergoing a significant transformation. Cryptocurrency and blockchain are at the forefront of this change, and their impact on the future of finance will continue to unfold in the future.

Sources

You can find the full list of sources and studies by reading through Adeola’s submission in PDF format.

![The Future of Crypto Gambling [2025 and Beyond]](https://casinosblockchain.io/wp-content/uploads/2023/12/future-of-crypto-gambling.webp)